South Korean retail buyers are pivoting away from Large Tech shares in america into high-risk, high-reward crypto-linked equities.

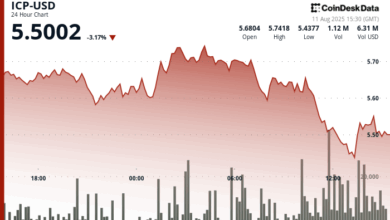

A Yonhap Information Company report citing knowledge from the Korean Heart for Worldwide Finance (KCIF) mentioned that the quantity of crypto-linked shares within the prime 50 net-bought shares by South Korean buyers rose from 8.5% in January to 36.5% in June earlier than declining to 31.5% in July.

The report added that internet purchases of the highest US Large Tech firms dropped to $260 million in July, down 84% from a month-to-month common of $1.68 billion between January and April.

The KCIF attributed the shift to the quickly rising acceptance of stablecoins into the worldwide monetary markets, saying that the not too long ago handed United States GENIUS Act contributed to the change.

BitMine gained $259 million from South Korean merchants since July

The Ether-stacking firm BitMine Immersion Applied sciences is the largest beneficiary of the shift in South Korean investor urge for food.

On Monday, a Bloomberg report citing knowledge from the Korea Securities Depository mentioned that retail buyers in South Korea poured $259 million into BitMine shares for the reason that starting of July. This makes the corporate the most-purchased abroad safety inventory within the nation in July.

Within the final 30 days, BitMine has elevated its ETH holdings by 410.68% to 833,100 ETH. With this, BitMine holds the world’s largest Ether (ETH) stack. As ETH surged previous $4,300 on Monday, the corporate’s holdings turned value almost $3.6 billion, up 24% from their worth final Tuesday.

Associated: NYSE-parent ICE faucets Chainlink to carry foreign exchange, treasured metals knowledge onchain

Ethereum co-founder Vitalik Buterin backs treasury corporations, warns of overleverage

Whereas Ethereum co-founder Vitalik Buterin backed public firms shopping for ETH, he warned buyers that the way forward for ETH should not come at the price of extreme leverage.

In a Bankless podcast, Buterin burdened that the “downfall of ETH” being from treasuries could be if it one way or the other changed into “an overleveraged sport.” Buterin outlined a worst-case chain response the place an ETH worth drop might flip right into a cascade of liquidations.

Regardless of this, he expressed confidence that ETH buyers are disciplined sufficient to keep away from such a case.

Journal: How Ethereum treasury firms might spark ‘DeFi Summer season 2.0’