Michael Saylor’s Technique, the world’s largest public holder of Bitcoin, has made its first BTC purchases in August, marking 5 years since adopting Bitcoin as a treasury asset.

Technique acquired 155 Bitcoin (BTC) for $18 million through the week ending Sunday, in keeping with a US Securities and Alternate Fee submitting on Monday.

Technique’s new Bitcoin purchases had been made at a mean value of $116,401 per coin, with BTC beginning the week at $114,000 and nearing all-time highs round $122,000 by Sunday, in keeping with CoinGecko.

The acquisition elevated Technique’s Bitcoin holdings to 628,946 BTC, bought for about $46.1 billion at a mean value of $73,288 per coin.

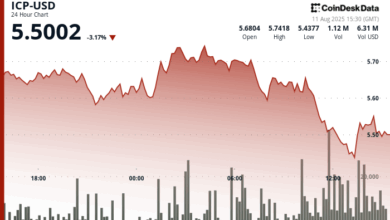

Technique purchased its first BTC on Aug. 11, 2020

Technique’s newest Bitcoin acquisition coincides with the fifth anniversary of its BTC treasury technique, launched on Aug. 11, 2020, with a $250 million purchase of 21,454 BTC.

Since Technique’s first BTC buy, the value of Bitcoin has surged 960% from round $11,400 to roughly $120,000 on the time of writing, giving huge returns on the funding.

Regardless of the rising costs, Technique, previously often called MicroStrategy, has by no means stopped shopping for BTC since, now holding greater than 600,000 BTC acquired over 74 purchases.

“Should you don’t cease shopping for Bitcoin, you received’t cease earning profits,” Technique co-founder Saylor mentioned in a put up on X on Sunday.

In late 2024, Saylor pledged to maintain shopping for Bitcoin irrespective of how excessive it surges. In June, the Technique co-founder doubled down on his Bitcoin value forecast, predicting that BTC goes to hit $21 million within the subsequent 21 years.

This can be a growing story, and additional info will likely be added because it turns into accessible.

Journal: How Ethereum treasury firms may spark ‘DeFi Summer time 2.0’