Disclaimer: The analyst who wrote this text owns shares in Technique.

Technique (MSTR) adopted a bitcoin normal 5 years in the past at this time, on Aug. 11, 2020, with its first buy of 21,454 BTC for $250 million. The acquisition marked a historic shift in company treasury technique.

To that time, former AI and software program improvement firm had seen its share worth stagnate for 20 years after the early 2000 tech boom-and-bust, falling over 95% from its peak.

Nevertheless, since August 2020, MSTR has delivered 100% common annual returns, compounding to over 3,000% cumulative positive factors, whereas bitcoin itself has returned almost 1,000% over the identical interval.

To fund its BTC accumulation, the corporate has employed numerous methods, elevating $46 billion by way of fairness and credit score, which incorporates $8.2 billion in excellent convertible debt and 4 perpetual most well-liked inventory choices, STRK, STRF, STRD, and STRC, designed to enchantment to completely different segments of the yield curve.

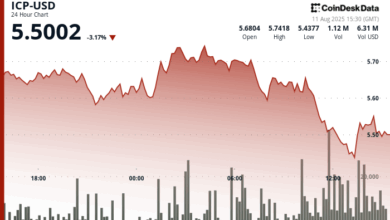

Contemporary buys proceed

The corporate Monday morning disclosed the acquisition of one other 155 BTC for $18 million — a fairly small weekly purchase, however however bringing its complete stoack to 628,946 cash valued at about $76 billion. That representis 3% of bitcoin’s mounted 21 million provide. With a mean price of about $74,000 per BTC, the corporate sits on unrealized positive factors of roughly $30 billion, or 65%.

MSTR is at this time one of the vital actively traded shares, posting $4.4 billion in each day buying and selling quantity simply behind Google (GOOG) at $4.9 billion. Open curiosity in MSTR choices totals $90 billion, additionally second to Google at $99 billion. Regardless of a $112 billion market cap in comparison with Google’s $2.4 trillion, the buying and selling exercise displays the extraordinary concentrate on MSTR.

Its success has impressed a wave of bitcoin treasury methods amongst different firms. The highest 100 public corporations now collectively personal 964,314 BTC, a lot of it financed by capital raises that comply with the MSTR playbook.