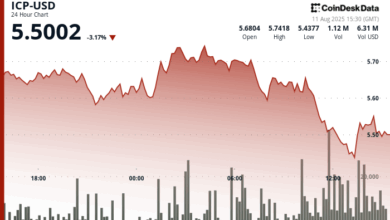

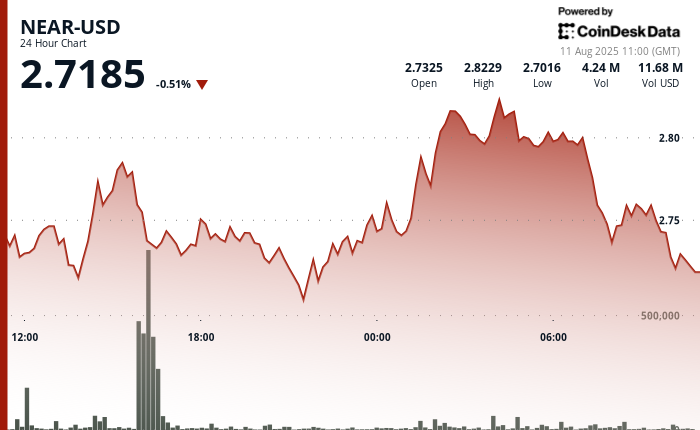

NEAR Protocol fell 0.98% within the ultimate hour Monday, sliding from $2.755 at 09:14 to $2.730 by 10:13 as promoting stress intensified. Makes an attempt to reclaim $2.765 resistance failed, even after an 81,064-unit quantity spike at 09:56, leaving sellers in management. Help at $2.729–$2.730 halted the drop, with consecutive zero-volume minutes into the shut hinting at near-term consolidation.

The late decline capped a risky 23-hour stretch from August 10–11, with NEAR swinging between $2.696 and $2.817. Regardless of recovering from early lows, it closed at $2.729, down 1.25% general. The whipsaw motion displays broader warning in crypto markets, the place geopolitical tensions and shifting commerce insurance policies have saved merchants on edge.

Whilst short-term sentiment wavered, digital asset funding merchandise drew $572 million in inflows—led by Ethereum ($268M) and Bitcoin ($260M)—signaling institutional confidence after latest payroll-driven outflows. Apex Make investments Digital’s partnership with Coinbase Asset Administration for a Swiss institutional program added to indicators of accelerating mainstream adoption.

NEAR’s capability to carry assist suggests potential stabilization if promoting eases, although merchants could look forward to recent catalysts earlier than re-engaging. Robust institutional inflows may assist offset macroeconomic headwinds, however the token stays delicate to international developments, making it a key gauge of broader crypto sentiment.

Key Technical Indicators

- NEAR reveals important volatility throughout 23-hour August 10-11 session, buying and selling $0.12 vary (4%) between $2.70 low and $2.82 peak.

- Cryptocurrency demonstrates restoration sample, declining to $2.71 earlier than staging rally to $2.82 at August 11 02:00, supported by elevated 3.99 million unit quantity.

- Key resistance emerges at $2.82 degree triggering reversal on excessive quantity, whereas assist materializes close to $2.70-$2.71 with a number of profitable bounces.

- NEAR continues risky trajectory throughout ultimate 60 minutes from August 11 09:14 to 10:13, experiencing pronounced $0.027 (-1%) decline from $2.76 to $2.73.

- Session characterised by persistent promoting stress with failed restoration makes an attempt, notably round $2.77 at 09:32 regardless of elevated 81,064-unit quantity at 09:56.

- Key assist ranges emerge round $2.73 zone stabilizing decline, whereas session concludes with consecutive zero-volume minutes suggesting market exhaustion and potential consolidation forward.

Disclaimer: Components of this text had been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.