Chainlink has launched a brand new product known as Information Streams, which delivers stay pricing knowledge for main US equities and exchange-traded funds (ETFs) immediately onto blockchain networks.

In keeping with an Aug. 4 assertion, Information Streams is designed to supply stay, low-latency knowledge on main US shares and ETFs, together with well-liked property like SPY, QQQ, NVDA, AAPL, and MSFT.

These knowledge streams are actually stay throughout 37 blockchain networks, enabling the creation of progressive use-cases corresponding to tokenized inventory buying and selling, perpetual futures, and artificial ETFs.

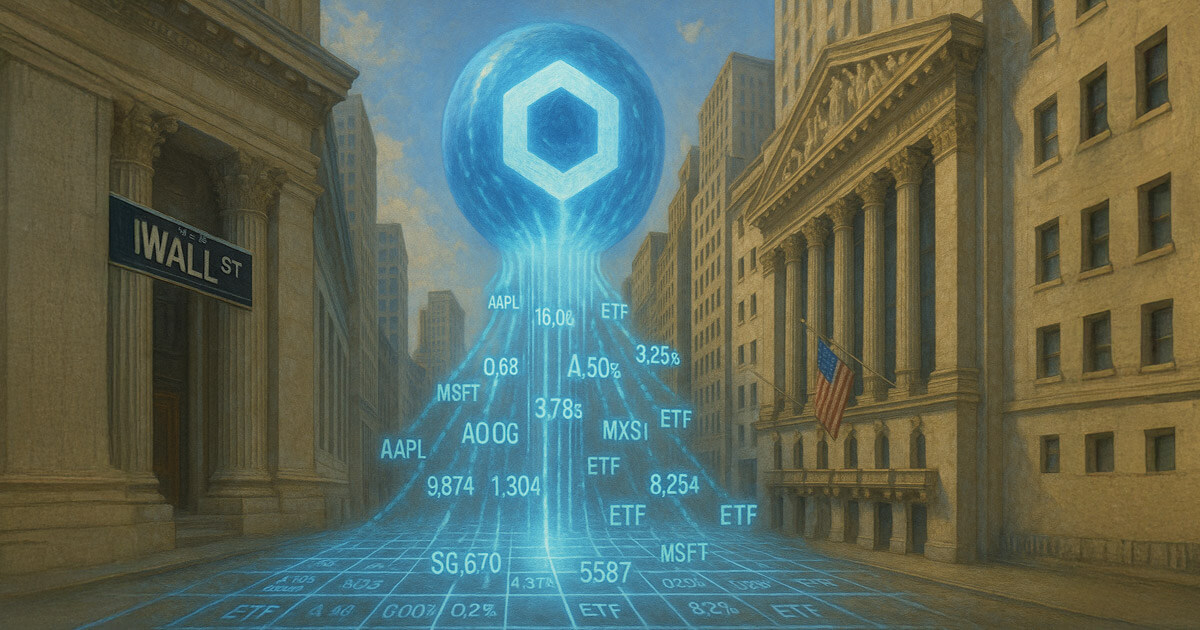

Chainlink’s knowledge stream

Information Streams combination real-time knowledge from a number of major and backup sources to make sure steady uptime. This info is processed via Chainlink’s decentralized oracle networks (DONs) and delivered on-chain utilizing a structured format.

Importantly, every knowledge level is timestamped, permitting platforms to distinguish between recent and outdated costs. This function additionally helps the automated suspension of buying and selling throughout market closures, guaranteeing that buying and selling is paused throughout off-hours.

These improvements allow builders to construct superior monetary merchandise like perpetual contracts, lending and borrowing platforms, artificial ETFs, and different advanced monetary devices.

With the RWA market projected to achieve $30 trillion by 2030, this infrastructure is changing into more and more important for guaranteeing safety and scalability in tokenized fairness markets.

Chainlink’s Chief Enterprise Officer, Johann Eid, remarked that Information Streams are important in bridging the hole between conventional finance and blockchain expertise.

In keeping with him:

“It is a vital leap ahead for tokenized markets—closing a crucial hole between conventional finance and blockchain infrastructure.”

Notably, prime DeFi protocols like GMX and Kamino Finance have already adopted Information Streams.

Talking on the mixing, Kamino Finance’s co-founder, Thomas Brief, emphasised that Information Streams would assist the platform improve its consumer expertise by offering a seamless interface whereas sustaining belief and safety throughout supported tasks.

He added:

“The launch of Information Streams for US equities and ETFs is a crucial milestone towards a very composable onchain monetary system that matches the size and class of conventional markets.”