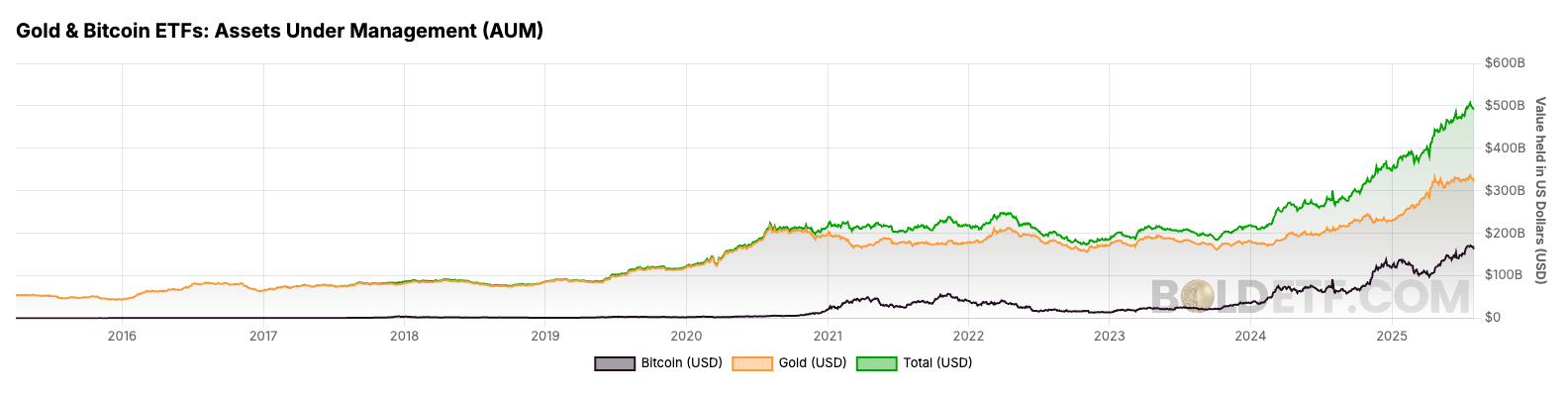

The mixed belongings below administration (AUM) of gold and bitcoin

alternate traded funds (ETFs) have crossed the $500 billion mark for the primary time, in accordance with the most recent knowledge from the Daring Report.

As of early August 2025, gold ETFs characterize roughly $325 billion, whereas bitcoin ETFs have surged to $162 billion.

Gold has lengthy been a staple in ETF markets, constantly growing in measurement annually. Nonetheless, bitcoin has been quickly gaining floor, significantly following the launch of US spot bitcoin ETFs.

Previous to their approval, international bitcoin ETF AUM was round $20 billion. Within the months since, that determine has grown greater than eightfold, marking a significant shift in institutional demand. In the identical interval, gold ETFs have additionally expanded, almost doubling from $170 billion.

The chart monitoring AUM progress over the previous 5 years illustrates this transformation. Whereas gold ETFs have adopted a gradual upward development, bitcoin ETFs present a sharper, newer acceleration.

Worth actions have mirrored this divergence. Because the US bitcoin ETF launch, bitcoin’s worth has climbed roughly 175%, in comparison with a 66% rise in gold. This displays each growing investor curiosity in bitcoin and its greater volatility profile.

Learn extra: Bitcoin Nonetheless on Monitor for $140K This 12 months, However 2026 Will Be Painful: Elliott Wave Skilled