Metaplanet (3350), a Tokyo-listed funding agency, mentioned it purchased one other 463 bitcoin

, emphasizing the cryptocurrency’s long-term shareholder worth at the same time as its inventory fell greater than 7% to take a seat at half the worth it held in June.

The newest buy price the corporate 7.995 billion yen ($540 million) at a median value of 17.3 million yen per bitcoin and takes whole holdings to 17,595 BTC. In all, Metaplanet has paid some 261.28 billion yen for its stash.

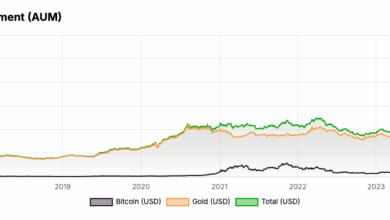

The acquisition comes amid a hunch in Metaplanet’s share value, which slid to 987 yen on Monday, nearly 50% beneath its June peak. With its worth reflecting each the altering value of bitcoin and the rise in its BTC holdings, Metaplanet is positioning itself as Asia’s closest proxy to a bitcoin exchange-traded fund.

The corporate reported BTC Yield, which gauges bitcoin accumulation per share, of 309.8% for fourth-quarter 2024 and 129.4% for the second quarter. The yield has slowed to 52.6% as of Aug. 4.