FX markets are comparatively quiet with restricted motion throughout the entire G10 currencies as we head into Wednesday’s NA session, Scotiabank’s Chief FX Strategists Shaun Osborne and Eric Theoret report.

USD regular into ADP, Q2 GDP, quarterly refunding and FOMC

“All eyes are on the 2pm ET Fed choice, the place a maintain (4.50%) is broadly anticipated and dovish dissent is anticipated. By way of efficiency, we’re seeing modest features in GBP, JPY, and MXN and modest losses for the AUD as the entire remaining G10 currencies commerce flat vs. the USD. The relative efficiency of the G10 currencies is providing no clear sign by way of the market’s tone, and asset markets are confirming as fairness futures consolidate slightly below Monday’s report excessive and as US yields commerce in a good vary with the 10Y regular following Tuesday’s ~10bpt decline.”

“Treasurys rallied and the curve flattened in response to a stable 7Y public sale on Tuesday, as traders provided clear indicators of demand forward of at the moment’s 8:30am ET quarterly refunding announcement. In commodities, oil costs are pulling again from the higher finish of their July vary and copper costs proceed to commerce defensively following their latest rally. Gold costs are regular, and we’re seeing an extension of the flat consolidation vary that we’ve noticed since April.”

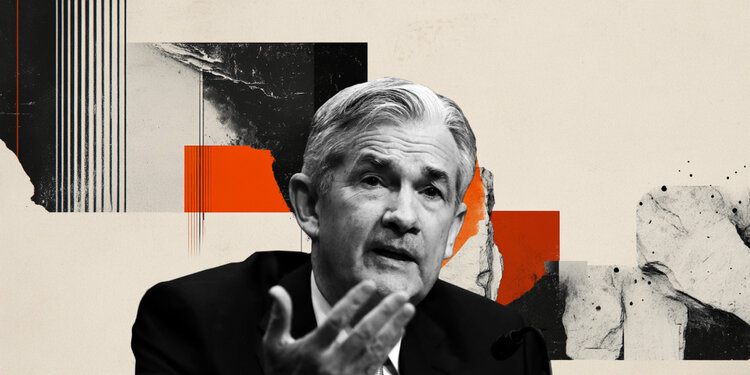

“Except for the Fed (2:00pm ET assertion, 2:30pm ET press convention) we glance to near-term threat within the 8:15am ET ADP employment launch (exp +75K), the 8:30am ET Q2 GDP launch, and the 10am pending house gross sales information. The bar to a dovish shock stays low, on condition that markets are nonetheless solely pricing in 16bpts of easing for September and fewer than 50bpts by 12 months finish. Chair Powell’s press convention tone will likely be key, as markets will look to the Fed’s evaluation of latest commerce coverage developments and their implications for the FOMC.”