Bitcoin-focused treasury agency Technique has launched a brand new class of perpetual most popular shares, the Sequence A Variable Fee Stretch Most popular Inventory (STRC), in keeping with a July 21 assertion.

Based on the agency, it plans to concern 5 million STRC shares at a face worth of $100 every, pending regulatory clearance and market situations.

STRC vs Cash Market Funds

STRC gives an preliminary annualized dividend of 9%, paid month-to-month and topic to board approval. Whereas the dividend fee is variable, Technique has capped any downward adjustment to 25 foundation factors per change, preserving yield stability.

This construction positions STRC as a compelling various to conventional cash market funds, which at present supply yields of round 4.25%.

Joe Consorti, Head of Progress at Theya Bitcoin, framed the product as a deliberate play to redirect capital from conventional fixed-income autos into Bitcoin-backed devices.

He said:

“Technique’s new variable fee most popular STRC has a 9% preliminary yield, and is concentrating on cash market funds. A $7.05 trillion market, about 25% of all US Treasuries, yielding simply ~4.25%.”

Past its excessive payout, STRC contains redemption mechanisms tailor-made for each Technique and its traders.

The corporate reserves the proper to redeem shares at $101 plus any unpaid dividends, whereas traders are granted a par-value exit within the occasion of a “basic change.” These phrases supply each flexibility and draw back safety, enhancing the product’s enchantment in unsure market situations.

Technique’s perpetual choices

STRC extends Technique’s rising household of Bitcoin-linked most popular securities choices.

Earlier points from the agency embody STRK, a convertible collection that pays an 8% mounted dividend and may shift into frequent fairness underneath outlined situations, giving holders upside optionality alongside earnings.

One other is STRF, a non-convertible collection structured round a ten% cumulative dividend. Based on the agency, unpaid arrears would stack and have to be made complete earlier than frequent distributions.

Moreover, STRD, one other non-convertible product, targets a ten% annual payout however doesn’t accrue missed dividends, making a cleaner, extra versatile obligation for the issuer.

Talking on these merchandise, Bitcoin analyst Adrian Cercenia mentioned:

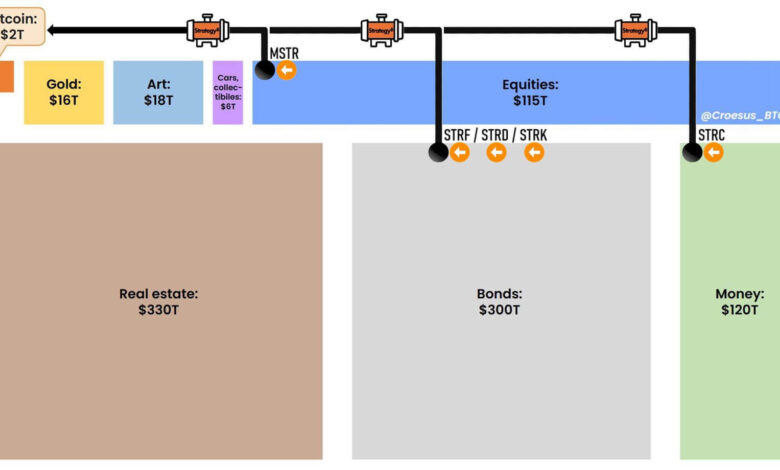

“Technique is constructing a ‘yield curve’ of merchandise for various threat appetites and return profiles..[The firm] is constructing a number of ‘pumps’ to extract fiat from swimming pools of stagnant or in any other case trapped liquidity and transmute into bitcoin.”

Based on him, the choices enable traders who need yield plus oblique Bitcoin publicity to diversify away from typical Treasuries, search earnings which will outpace inflation, and specific a view on digital belongings with out shopping for spot BTC outright.