Key takeaways:

-

Bitcoin hit $122,000 all-time excessive on July 14, however onchain knowledge reveals no indicators of overheating, suggesting extra progress potential in 2025.

-

BTC worth resistance at $124,000-$136,000 stays the primary barrier for now.

Bitcoin (BTC) analysts say that the BTC market shouldn’t be overheated regardless of new all-time highs of round $123,000 earlier this week.

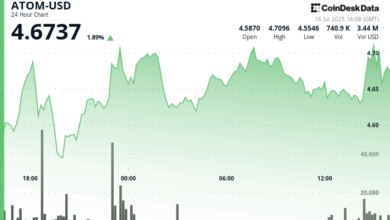

Information from Cointelegraph Markets Professional and TradingView reveals that Bitcoin worth motion has established a brand new vary in decrease timeframes, and market observers have key assist ranges of their sights.

Bitcoin market not overheated but

For CryptoQuant analyst Axel Adler Jr., Bitcoin has not but reached its peak vary.

The analyst shared a chart displaying the absence of a peak sign, which generally seems at main market tops.

The Bitcoin peak sign is a metric that signifies that the market is overheated and a corrective part is turning into probably.

Associated: Bitcoin ETF inflows present establishments ‘doubled down’ on BTC at $116K

It seems when “the mixed normalized market to realized worth index and 30 day/ 365 day worth days destroyed ratio rating reaches or exceeds 1,” Adler Jr. defined, including:

“The Peak Sign solely seems at main market tops, and it hasn’t proven up this time, suggesting we’re not at a peak but.”

Equally, Bitcoin realized Cap-UTXO Age Bands, a metric that reveals the distribution of realized cap of a specified age cohort, additionally means that BTC “hasn’t reached an overheated state,” in line with CryptoQuant Crypto Dan.

In March 2024 and December 2024, when Bitcoin was at peak highs, the proportion of the realized cap held by the 1-day to 1-week UTXO age group was as excessive as 14%. This proportion is presently round 5% regardless of Bitcoin’s current all-time highs.

In a Wednesday evaluation, Crypto Dan wrote:

“Regardless of the value rising even larger, the truth that overheating has considerably decreased in comparison with earlier short-term peaks means that Bitcoin may proceed to interrupt all-time highs and rise considerably within the second half of 2025, leaving sturdy potential for progress.”

Cointelegraph additionally reported that Bitcoin’s MVRV Z-Rating stays nicely beneath historic peak ranges, signaling BTC worth can climb additional.

Onchain knowledge reveals key Bitcoin worth ranges to look at

Bitcoin’s short-term holder (STH) price foundation, CryptoQuant analyst Crazzyblockk outlines key ranges that merchants ought to deal with.

This statement comes from Bitcoin’s realized worth mannequin. It makes use of the typical buy costs of STHs, together with their normal deviations, to identify necessary areas the place patrons are energetic and costs have a tendency to maneuver.

On the upside, the primary main resistance sits at $124,000, representing the typical price foundation of STHs pushed one normal deviation larger.

“Traditionally, this band usually coincides with profit-taking and native tops,” Crazzyblockk defined.

The higher resistance is at $136,000; the typical price foundation of buyers who’ve held BTC for lower than 30 days is pushed one normal deviation larger. That is “probably the most aggressive cohort,” the analyst mentioned, including:

“When BTC pushes into this space, the market is usually in overbought situations with extreme unrealized revenue for brand new patrons.”

On the draw back, merchants ought to control $113,000 — matching the 0.5 normal deviation above the STH realized worth; $111,000 — the typical price foundation of buyers who acquired BTC up to now month; and $101,000, the baseline STH realized worth.

$101,000 is the “most crucial assist for Bitcoin’s medium-term bullish construction,” the analyst mentioned.

“Traditionally, staying above this zone alerts strongholder conviction and development continuation.”

The market worth realized worth (MVRV) metric, which reveals whether or not the asset is overvalued or undervalued, means that BTC worth nonetheless has extra room for additional growth earlier than the acute stage round $124,000, marking a key level of resistance.

On the draw back, a key space of curiosity sits between $113,700 and $115,300, a zone aligned with the 200-day EMA, which presents dynamic assist. The subsequent necessary stage beneath that’s $107,500, the +0.5 STD MVRV band.

As Cointelegraph reported, Bitcoin should reclaim the $119,250–$120,700 zone to renew its bullish momentum and intention for brand new highs above $123,000.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.