GameStop is taking a cautious, impartial method to Bitcoin (BTC) and doesn’t doesn’t intend to emulate the aggressive methods of different crypto-heavy treasury companies like Technique, in response to CEO Ryan Cohen, who mentioned Tuesday that the corporate

In an look on CNBC’s Squawk Field on July 15, Cohen defined that GameStop’s $512 million Bitcoin buy in Could was designed as a hedge towards inflation and financial debasement.

He defined that the Bitcoin buy was not a sign of long-term accumulation or a pivot into changing into a Bitcoin-native enterprise.

Cohen additional clarified that GameStop wouldn’t observe the mannequin of companies like Technique, which has constructed one of many largest Bitcoin treasuries on the planet.

Cohen emphasised that GameStop maintains a powerful steadiness sheet, with over $9 billion in money and marketable securities, and can stay disciplined in the way it deploys capital.

He characterised the corporate’s Bitcoin place as opportunistic, including that future funding selections will give attention to defending draw back danger whereas in search of significant upside.

The corporate just lately raised $2.7 billion by a inventory providing, prompting hypothesis about whether or not it would increase its Bitcoin holdings. Whereas Cohen acknowledged the capital increase, he gave no particular indication that the agency would allocate extra to crypto.

Below Cohen’s management, GameStop has refocused on collectibles and buying and selling playing cards, cutting down bodily operations whereas enhancing profitability. As a part of this strategic shift, the corporate is evaluating the opportunity of accepting crypto as a type of fee for buying and selling card purchases.

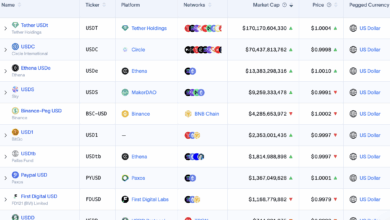

Cohen acknowledged that the agency is actively assessing market demand for such a fee possibility and is open to contemplating a broad vary of digital belongings somewhat than limiting itself to a single token.

GameStop beforehand operated an NFT market and developed a crypto pockets, although each have been shut down between late 2023 and early 2024 on account of regulatory uncertainty within the U.S.

Whereas GameStop’s present crypto involvement facilities on its Bitcoin holdings, the corporate’s exploration of digital funds suggests it might proceed to combine blockchain into its broader retail and funding technique, albeit at its personal tempo.