BONK noticed a 15% breakout, pushed by a leap in buying and selling exercise and rising on-chain traction.

With open curiosity growing 9% and derivatives quantity additionally larger, market contributors are signaling elevated conviction within the Solana-based meme token’s upside potential, in keeping with CoinDesk Analysis’s technical evaluation information mannequin.

A lot of the thrill stems from BONK’s evolving fundamentals. The challenge lately introduced plans to burn 1 trillion tokens, a transfer that might considerably cut back provide and strengthen the case for long-term appreciation.

The neighborhood is pushing aggressively towards reaching 1 million on-chain holders, a symbolic milestone for adoption, which can even set off the aforementioned burn.

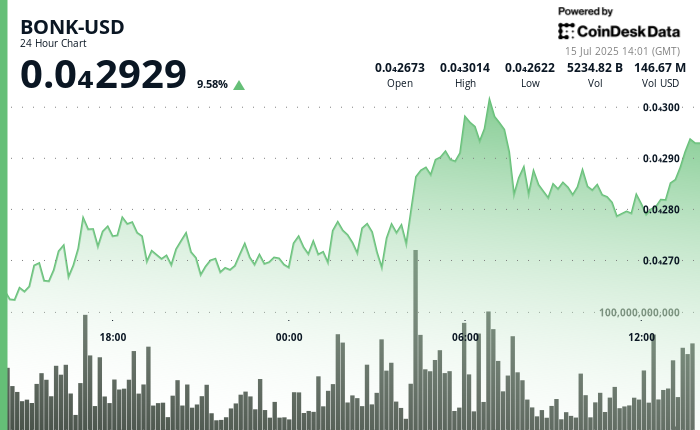

The momentum kicked off on July 14 at 13:00 UTC, with BONK rising steadily from $0.000027 and peaking at $0.000031 by 07:00 on July 15. That rally was accompanied by large exercise — over 3.5 trillion tokens had been traded through the peak hour, marking a interval of institutional-grade breakout quantity.

Grayscale’s inclusion of BONK on its asset watchlist additional signaled a shift in notion, as meme tokens evolve from speculative performs to reliable automobiles for market participation.

With deflationary mechanics, deepening liquidity, and rising institutional validation, BONK could also be primed for additional momentum within the days forward.

Technical Evaluation Highlights

- BONK rallied 15% to $0.000031 (July 14 13:00–July 15 12:00 UTC).

- Buying and selling quantity topped 3.5 trillion tokens through the 06:00–07:00 UTC breakout part.

- Open curiosity surged 9%, whereas derivatives exercise spiked sharply.

- A deliberate 1 trillion BONK token burn introduces a deflationary catalyst.

- Worth consolidated at $0.000028 following the rally; help held at $0.000026

- BONK spiked 2% in minutes at 12:30 UTC on 75 billion tokens exchanged.

- Present value: $0.0000294, with each day positive aspects of seven.8% and bullish construction intact.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.