The Core Basis, the group behind the Core blockchain, is launching a brand new revenue-sharing mechanism for the Web3 trade supposed to shake up how stablecoin issuers and builders increase funds.

Rev+ claims to be the primary protocol-level program that instantly rewards builders, stablecoin issuers and decentralized autonomous organizations (DAOs) primarily based on their created consumer worth. As soon as launched, it is going to permit tasks to earn income from user-generated fuel charges on their blockchain purposes.

It may present a sustainable income stream for builders, who had been beforehand compelled to launch cryptocurrencies to boost venture funds.

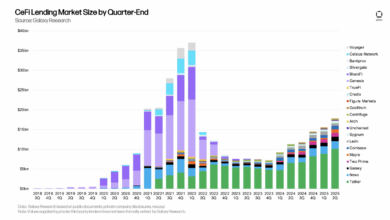

“Stablecoins now account for over one-third of DeFi income,” wrote Hong Solar, the institutional lead on the Core Basis, including:

“But issuers don’t earn income from transaction exercise. Rev+ will change that by aligning incentives in order that the tasks powering Web3 really receives a commission when their tokens transfer.”

Associated: Satoshi-era whale strikes $4.6B in Bitcoin after 14-year HODL

How Core’s Rev+ program will generate income

The Core blockchain is the primary Ethereum Digital Machine (EVM)-compatible Bitcoin staking protocol.

Transactions triggered by Core good contracts — resembling stablecoin swaps, transferring collateral or utilizing a vault — will award recurring income for the issuers by means of direct payouts after transactions or by means of a revenue-sharing pool.

The income sharing pool is predicated on the extent of contribution to the Core blockchain, factoring in whole transaction rely, new distinctive addresses, notional worth and whole transaction charges generated.

The income pool is “distributed amongst collaborating companions throughout every cycle,” Wealthy Rines, an preliminary contributor to Core DAO, informed Cointelegraph, including:

“Whereas the pool could also be modest at launch, Rev+ establishes a sustainable, usage-based monetization mannequin designed to develop with Core’s community.”

Associated: Bitcoin flips Amazon’s $2.3T market cap to develop into fifth world asset

Crypto trade wants extra collaborative financial incentives

Notable trade leaders resembling Cardano founder Charles Hoskinson have beforehand referred to as for the trade to embrace extra collaborative financial incentives to compete with the rising menace of centralized tech giants getting into the Web3 trade.

The decentralized finance (DeFi) trade’s “round financial system” typically signifies that the rally of a particular cryptocurrency is bolstered by funds exiting one other token, limiting the expansion of the trade, stated Hoskinson, talking at Paris Blockchain Week 2025.

“The issue proper now, with the way in which we’ve performed issues within the cryptocurrency area, is the tokenomics and the market construction are intrinsically adversarial. It’s sum 0,” stated Hoskinson.

“As a substitute of choosing a battle, what you need to do is you need to discover tokenomics and market construction that lets you be in a cooperative equilibrium.”

Journal: Crypto wished to overthrow banks, now it’s changing into them in stablecoin battle