New patrons getting into the Bitcoin market are seen as price-agnostic and are scooping up the cryptocurrency sooner than miners can provide, a probable boon for the value of Bitcoin.

“Presently, the mixed steadiness of those cohorts is increasing at a fee of roughly 19.3K BTC monthly,” Bitfinex analysts mentioned in a markets report on Monday.

Smaller Bitcoin traders “relentlessly accumulating”

The analysts identified that the Shrimp (<1 BTC), Crab (1–10 BTC), and Fish (10–100 BTC) Bitcoin (BTC) holder teams are rising their Bitcoin portfolio a lot sooner than the present month-to-month issuance fee, which has been round 13,400 BTC for the reason that April 2024 halving.

“Demand from this phase alone is greater than sufficient to soak up all new provide,” they mentioned, including that they’re persistently shopping for regardless of the value:

“This cohort-level accumulation pattern helps the broader bullish narrative that new patrons getting into the Bitcoin market are price-agnostic patrons and are relentlessly accumulating with restricted intervals.”

The aggressive accumulation comes as Bitcoin continues to set new all-time highs. On Monday, Bitcoin reached a brand new all-time excessive of $122,884 earlier than retracing to $119,860 on the time of publication, based on CoinMarketCap knowledge.

Regardless of the bullish momentum, some warn of potential volatility forward.

Redstone co-founder Marcin Kazmierczak informed Cointelegraph that whereas many crypto analysts are actually calling for short-term Bitcoin targets as excessive as $140,000, “historical past teaches us that parabolic strikes usually invite sharp corrections.”

Rising sentiment “warrants cautious place sizing”

Kazmierczak pointed to the big variety of leveraged positions worn out up to now 24 hours as a reminder that “volatility stays Bitcoin’s fixed companion.”

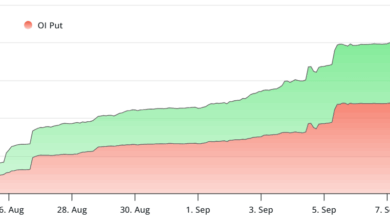

Practically $430 million in Bitcoin shorts have been liquidated as the value surged previous $121,000, based on CoinGlass knowledge.

Associated: ‘Do not get trapped!’ Bitcoin value evaluation sees dip with $118.8K in focus

He mentioned traders ought to method upcoming Bitcoin value milestones with warning, not euphoria, warning that rising sentiment “warrants cautious place sizing.”

The Crypto Concern & Greed Index, which measures general market sentiment, posted a “Greed” rating of 74 on Monday, marking the fifth consecutive day in Greed.

Santiment analyst Brian Quinlivan not too long ago warned that whereas rising sentiment could appear constructive, related spikes in dealer optimism have been adopted by Bitcoin value drops on each June 11 and July 7.

In the meantime, crypto buying and selling agency QCP Capital mentioned, “Bitcoin’s relentless rally reveals no indicators of fatigue, surging previous $122K as momentum accelerates.”

Journal: Inside a 30,000 telephone bot farm stealing crypto airdrops from actual customers

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a choice.