Simon Gerovich, CEO of Tokyo-based Metaplanet, is a part of a consortium that’s negotiating to amass a controlling stake in SGA, a publicly traded software program providers firm listed on South Korea’s KOSDAQ. The deal, if finalized, would place SGA to amass Bitcoin as a part of a broader digital asset technique.

Whereas Gerovich is listed as an unbiased investor — not appearing on behalf of Metaplanet — the transfer aligns with the corporate’s rising Bitcoin treasury technique. In response to a press launch from Prime Win Worldwide, (SORA on the Nasdaq inventory trade), “proceeds from the issuance might be used for strategic asset acquisitions and basic company functions.”

Acquisitions corresponding to this are a part of a broader technique to speed up company Bitcoin adoption throughout Asia by remodeling conventional corporations into Bitcoin-aligned entities, utilizing offers to place corporations like DV8 and SGA as automobiles for Bitcoin publicity in regional capital markets.

The board of SGA and the Korean Monetary Providers Fee accepted the issuance of 58 million new shares to the consortium, however no definitive settlement has been signed. If accomplished, Prime Wind, rebranded as Asia Technique LLC, would change into the most important shareholder within the firm.

SGA stated it’ll preserve its core enterprise operations whereas leveraging the consortium’s experience to pursue new initiatives within the digital asset house.

Associated: Technique baggage one other $472M in BTC as Bitcoin jumps to new highs

M&A Bitcoin treasury technique pushed in Asia

Since its partnership with Sora Ventures in Could 2025, Prime Win has shifted its focus to digital property. As a part of this transition, the corporate appointed Sora Ventures founder, Jason Fang, as co-CEO and board member, signaling a deeper alignment with the Bitcoin-first funding strategy.

Earlier this month, a Metaplanet-led consortium of traders — together with Sora Ventures, UTXO Administration, Moon Inc. and Kliff Capital — filed to amass DV8, a publicly listed Thai electronics firm.

Metaplanet acquires 797 extra Bitcoin

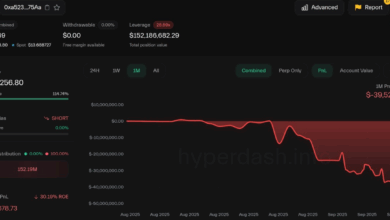

On Sunday, Metaplanet introduced one other Bitcoin buy, with a further 797 BTC moved to its treasury at a mean worth of $117,451 per coin. That brings the agency’s complete holdings to 16,352 BTC, at the moment valued at round $1.64 billion.

Metaplanet has acquired 1112 BTC for ~$117.2 million at ~$105,435 per bitcoin and has achieved BTC Yield of 266.1% YTD 2025. As of 6/16/2025, we maintain 10,000 $BTC acquired for ~$947 million at ~$94,697 per bitcoin. $MTPLF pic.twitter.com/8nmQ2RaOIF

— Simon Gerovich (@gerovich) June 16, 2025

Metaplanet adopted Michael Saylor’s Bitcoin playbook in April 2024, when it first acquired 97.85 BTC. In response to knowledge from Bloomberg, the corporate’s inventory rose over 4,800% within the 12 months following its preliminary buy. It’s at the moment the world’s fifth-largest public holder of Bitcoin.

Saylor’s Technique, the primary firm to undertake the Bitcoin commonplace and popularize it, holds 601,550 BTC on the time of writing.

Journal: Pakistan will deploy Bitcoin reserve in DeFi for yield, says Bilal Bin Saqib