It’s formally “Crypto Week,” a multi-day occasion the place leaders within the US Home of Representatives hope to vote on three cryptocurrency payments anticipated to bolster the nationwide crypto trade.

The CLARITY Act, the GENIUS Act and the Anti-CBDC Surveillance State Act are anticipated to undergo debate, amendments and a ultimate vote over the approaching days.

“Crypto Week” was introduced by French Hill, chair of the Home Committee on Monetary Providers, on July 3. Hill mentioned the laws would set up “a transparent regulatory framework for digital belongings,” in addition to set the bottom guidelines for dollar-pegged stablecoin issuance, and goals to dam central financial institution digital forex (CBDC) issuance “to safeguard People’ monetary privateness.”

Whereas “Crypto Week” has garnered a lot anticipation amongst Republicans within the Home, Democratic leaders are actively campaigning in opposition to what they name “harmful laws.”

Listed here are the important thing dates to look out for.

Key dates and milestones throughout “Crypto Week”

On Monday, the Home Guidelines Committee will meet to debate all three payments. It’s going to set the particular guidelines that “gives the phrases and circumstances of debate.” On Tuesday, the Home will start discussing the payments, and the vote can begin after the talk ends.

Last passage votes on the Readability Act and the Anti-CBDC Surveillance State Act are scheduled for Thursday. The GENIUS Act’s ultimate passage vote is predicted on Friday.

Associated: GENIUS Act might strengthen greenback energy, write ‘rulebook’ for world monetary system

The Digital Asset Market Readability Act (CLARITY Act)

The Digital Asset Market Readability (CLARITY) Act was launched on the finish of June and goals to offer a regulatory framework for the crypto trade. This consists of defining the roles of the Securities and Trade Fee (SEC) and Commodity Futures Buying and selling Fee (CFTC) of their regulation.

The invoice additionally goals to “present an exemption from the Securities Act of 1933’s registration requirement for gives of funding contracts involving digital commodities on mature blockchains that meet sure circumstances.”

However not everyone seems to be on board. Earlier this month, Massachusetts Senator Elizabeth Warren mentioned that below these guidelines, publicly traded firms might basically bypass US securities legal guidelines.

Associated: Coinbase crypto foyer urges Congress to again main crypto invoice

The Guiding and Establishing Nationwide Innovation for US Stablecoins Act (GENIUS Act)

The Guiding and Establishing Nationwide Innovation for US Stablecoins Act (GENIUS Act) was launched in February, lower than two weeks after President Donald Trump took his workplace. The invoice handed the Senate on June 17.

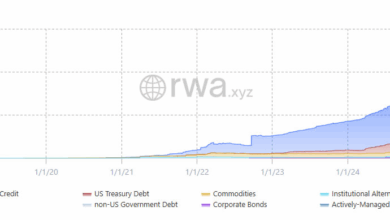

The GENIUS Act units guidelines for the kind of entities which will problem stablecoins. It establishes that “issuers should preserve reserves backing the stablecoin on a one-to-one foundation” in US {dollars} or different equally liquid belongings. It additionally extends the Financial institution Secrecy Act to stablecoin issuers.

Some financial and authorized observers have famous that the backing clause of the GENIUS Act might pose a systemic threat to the US financial system.

Anti-CBDC Surveillance State Act

The Anti-CBDC Surveillance State Act was launched in early March and seeks to forestall the Federal Reserve, the US’s central financial institution, from issuing a CBDC. The Federal Reserve would even be prohibited from utilizing a CBDC to affect financial coverage, and make sure that solely Congress can problem a digital greenback.

On the finish of April, the Home Monetary Providers Committee superior the Anti-CBDC Surveillance State Act in a 27-22 vote. Consultant Brad Sherman described the invoice as a “phrase salad” that favored “crypto bros.”

Journal: How crypto legal guidelines are altering internationally in 2025