Investor demand for digital asset funding merchandise surged final week, with whole inflows reaching $3.7 billion, the second-largest weekly influx on document and the very best in 2025.

The CoinShares weekly report confirmed that this was evidenced by the inflows on July 10, when the market recorded its third-largest single-day influx of greater than $1.1 billion.

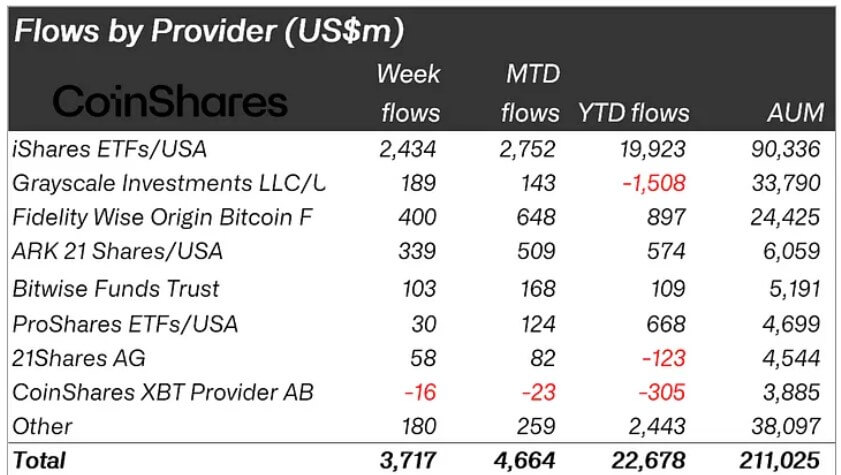

In accordance with James Butterfill, Head of Analysis at CoinShares, final week’s influx marks the thirteenth consecutive week of web inflows, pushing the cumulative whole to $21.8 billion and year-to-date inflows to $22.7 billion.

He famous that these merchandise’ belongings underneath administration (AUM) additionally climbed to a document $211 billion, breaking above the $200 billion mark for the primary time. On the identical time, buying and selling volumes hit $29 billion through the week, greater than double the annual common.

US Bitcoin ETFs drive market

Bitcoin stays the dominant pressure behind these inflows, attracting $2.7 billion within the final week alone. This pushed Bitcoin’s AUM to $179.5 billion, equal to over 54% of the entire AUM held in gold exchange-traded merchandise (ETPs).

A significant driver of this momentum was the sustained influx into US-listed Bitcoin ETFs, which noticed back-to-back every day investments exceeding $1 billion.

On July 10 and 11 alone, the 12 Bitcoin ETF merchandise raked in a mixed $2.21 billion—marking the biggest two-day whole since spot Bitcoin ETFs started buying and selling in January 2024.

BlackRock’s iShares Bitcoin ETF (IBIT) performed a big function on this pattern, contributing practically $20 billion in inflows to this point this 12 months. IBIT now manages over $90 billion in belongings, accounting for a considerable portion of the entire market AUM.

In the meantime, Brief Bitcoin merchandise confirmed restricted motion, with solely $400,000 in inflows regardless of Bitcoin climbing above $120,000 to set a brand new all-time excessive.

Ethereum leads altcoins influx

In accordance with the CoinShares report, Ethereum adopted carefully behind with $990 million in inflows—its fourth-largest weekly whole on document.

This marks its twelfth consecutive week of inflows, which now symbolize 19.5% of its whole AUM, greater than double Bitcoin’s 9.8% for a similar interval.

In whole, Ethereum’s inflows this 12 months have reached a document excessive of over $4 billion and present the rising institutional curiosity within the digital asset.

Then again, different main altcoins confirmed assorted efficiency.

Solana attracted $92.6 million in inflows, whereas XRP noticed $104 million in outflows—the biggest for the week.

Regardless of this, XRP’s year-to-date inflows nonetheless stand at $231 million, whereas Solana’s have climbed to $206 million.

Market observers famous that these numbers mirror robust investor curiosity in digital asset funding merchandise amid the pro-crypto coverage tone of the Trump administration.