On June 11, PayPal introduced plans to launch its U.S. dollar-backed stablecoin, PayPal USD (PYUSD), on the Stellar blockchain community, pending regulatory approval from the New York State Division of Monetary Providers. If permitted, the transfer would mark the enlargement of PYUSD past its present availability on Ethereum and Solana.

PayPal described Stellar as a blockchain tailor-made for low-cost, high-speed funds with robust real-world utility. By including help for Stellar, the corporate goals to enhance the accessibility and value of PYUSD for funds, cross-border transfers, and monetary providers. The mixing is predicted to reinforce every day cost choices and supply customers with expanded entry to financing instruments resembling working capital and small enterprise loans—areas the place Stellar is already lively.

The press launch emphasised Stellar’s present world infrastructure, together with a broad community of on- and off-ramps, native cost techniques, and digital wallets, which may assist convey PYUSD to customers in over 170 nations. PayPal additionally highlighted potential advantages for liquidity and settlement by means of PayFi, an rising digital financing mechanism that might permit companies to entry real-time capital disbursed in PYUSD on Stellar.

Might Zabaneh, PayPal’s vice chairman for digital currencies, mentioned the partnership would assist advance the usage of blockchain in cross-border funds. Denelle Dixon, CEO of the Stellar Growth Basis, mentioned the collaboration may assist convey sensible stablecoin use to rising markets and small companies globally.

PYUSD is issued by Paxos Belief Firm and is totally backed by money and cash-equivalent reserves, with a hard and fast redemption worth of $1.00 per token.

Earlier this in a brief video launched by Stellar Basis, Ian Burrill, a Senior Director at PayPal who manages the crypto engineering crew, defined why his agency was excited in regards to the launch of PYUSD on Stellar. Burrill mentioned that Stellar is a quick, low-cost community and it extends PYUSD’s attain to 180 plus nations. He went on to say that enabling retailers to make use of PYUSD on Stellar lets them ship cash in real-time, which makes for extra environment friendly capital administration.

Technical Evaluation

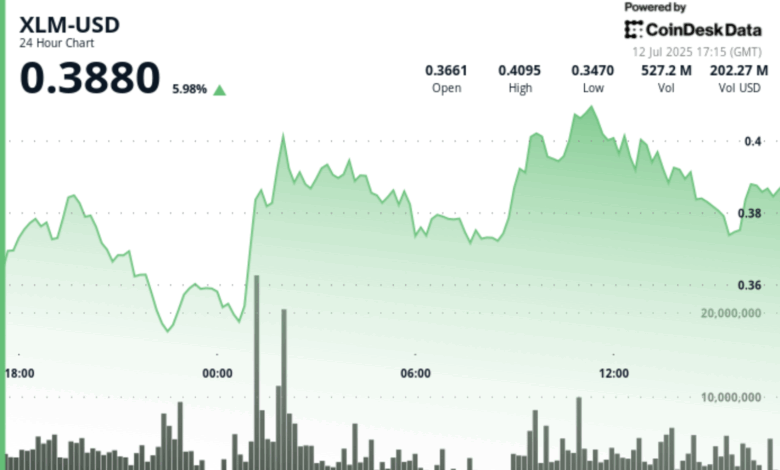

- Stellar’s XLM token recorded important worth appreciation throughout a 24-hour buying and selling interval from July 11 at 17:00 UTC to July 12 at 16:00 UTC, with shares transferring inside a $0.071 vary representing roughly 20.59% volatility between a session low of $0.345 and excessive of $0.416, based on CoinDesk Analysis’s technical evaluation mannequin.

- Probably the most notable buying and selling exercise occurred throughout early morning hours on July 12 at 01:00, UTC when XLM shares superior from $0.354 to $0.393 on substantial quantity of 551.38 million items, considerably exceeding the 24-hour common of 234.19 million and establishing technical help close to the $0.354 worth stage.

- The upward momentum persevered by means of July 12 at 11:00 UTC, reaching a session excessive of $0.416, earlier than encountering resistance within the $0.400-$0.403 vary the place institutional profit-taking appeared to restrict additional advances.

- Within the remaining hour of buying and selling from July 12 at 15:47 UTC to 16:46 UTC, XLM demonstrated renewed energy with a 3.89% advance from $0.37 to $0.39, extending the session’s optimistic momentum.

- Probably the most important worth motion occurred between 16:03-16:08 UTC when shares climbed from $0.374 to $0.385 on elevated quantity of 13.16 million and 17.14 million respectively, nicely above the hourly common of three.2 million items.

- This exercise established technical help round $0.385-$0.387 the place shares consolidated by means of the session’s remaining half-hour, with market members eyeing potential continuation towards the $0.39-$0.40 resistance ranges recognized in broader technical evaluation.

Disclaimer: Elements of this text have been generated with the help from AI instruments and reviewed by our editorial crew to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.