As bitcoin

pushed previous all-time highs and different cryptocurrencies surged, the rise in stablecoin provide is providing a sign that this rally might have deeper roots.

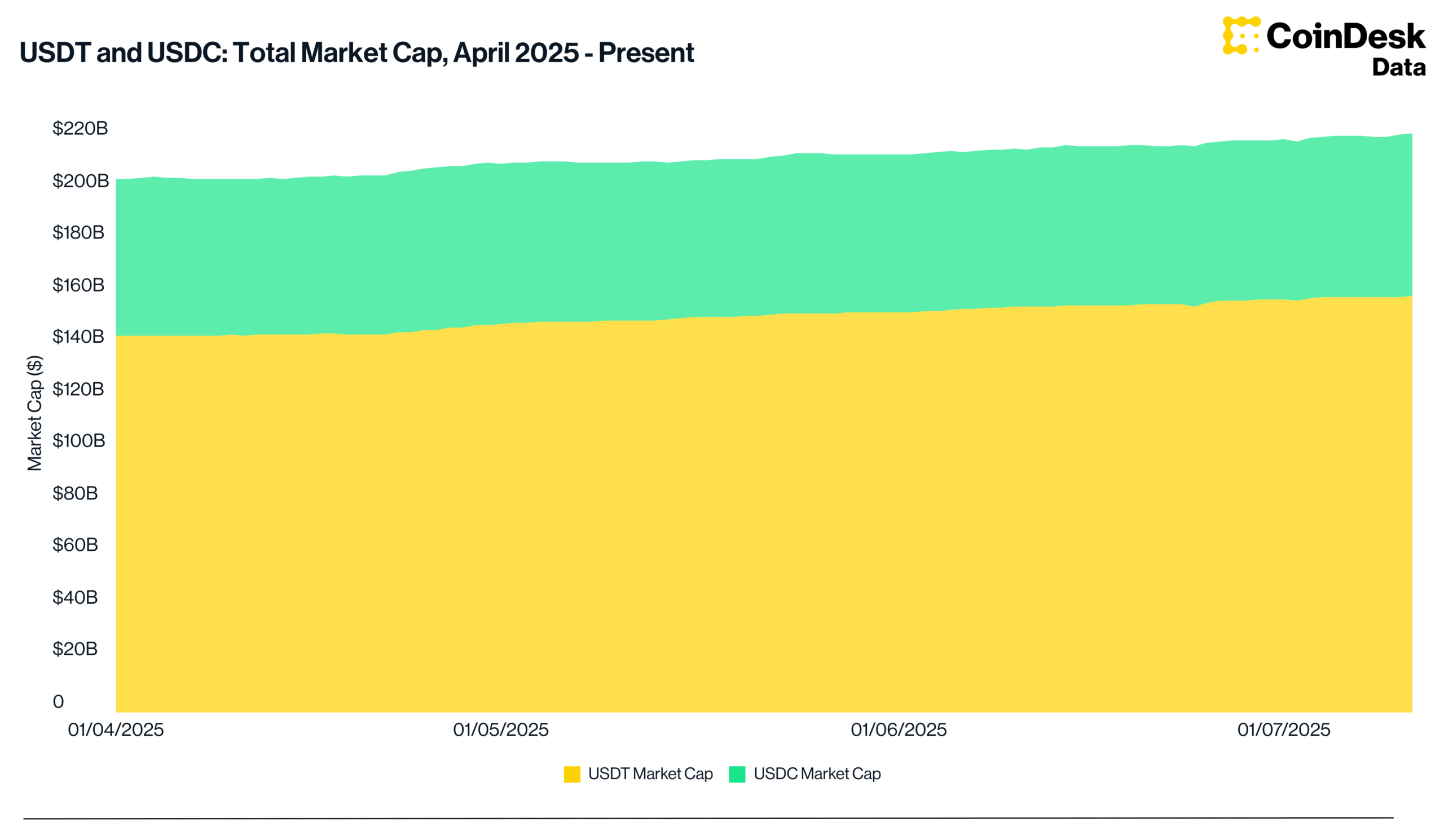

Tether’s USDT and Circle’s USDC, the 2 largest dollar-pegged stablecoins, every reached new file provides this week, in response to TradingView knowledge. Because the begin of July, USDC’s market cap has grown by $1.3 billion, reaching $62.8 billion, whereas USDT added $1.4 billion to hit almost $160 billion.

Wanting additional again to April, when the market hit a short-term low, the expansion is much more pronounced. USDT expanded by $15.2 billion—roughly 10.5%—and USDC added $2.7 billion, or 4.6%.

Stablecoins are cryptocurrencies with costs tied to an exterior asset, predominantly to the U.S. greenback. Whereas they’ve been more and more widespread for funds, the asset class serves as a key supply of liquidity and buying and selling pairs on crypto exchanges.

Therefore, analysts usually deal with their development as a proxy for recent capital getting into the broader crypto financial system.

Beforehand, intervals of accelerating stablecoin development coincided with sharp rallies in bitcoin, Caleb Franzen, founding father of Cubic Analytics, identified in a chart shared on X.

Learn extra: Bitcoin’s ‘Low Volatility’ Rally From $70K to $118K: A Story of Transition From Wild West to Wall Avenue-Like Dynamics