BNB is edging nearer to the $700 mark as merchants responded to a recent $1 billion token burn and rising curiosity in utilizing the asset as a company treasury reserve.

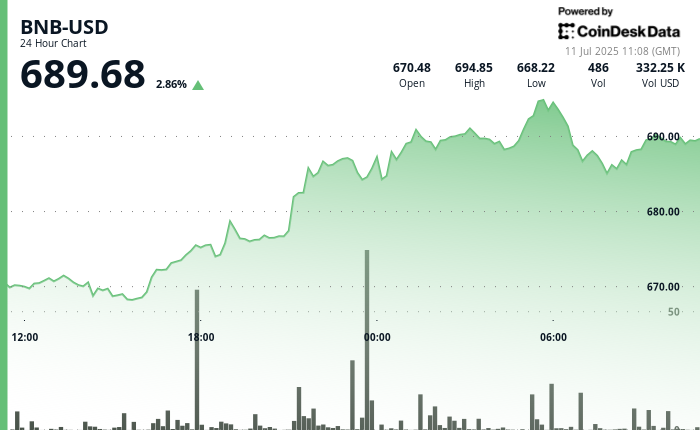

Over the past 24-hour interval, BNB rose about 2.8%, from $670.40 to $688.7. Buying and selling surged as the worth moved up, amid a broader cryptocurrency market rally that noticed bitcoin hit a brand new all-time excessive above $118,000.

The worth briefly hit an intraday peak close to $695 earlier than settling into a decent vary round $689.

The wally wasn’t simply fueled by the rising crypto tide. Binance’s thirty second quarterly burn completely eliminated about 1.59 million BNB from circulation, bringing the entire worth burned to 265,605 BNB in keeping with a monitoring web site.

The burns are a part of a deflationary technique aiming to chop the entire provide to 100 million tokens.

On high of this, over 30 groups are reportedly engaged on methods to construction public-company treasury reserves in BNB, with funding agency 10X Capital backing a plan for a $500 million U.S.-listed BNB treasury firm.

Lively addresses on BNB Chain have doubled since March, hovering round 2.5 million day by day, in keeping with Nansen information. Equally, common day by day transaction volumes have tripled.

Traders are watching to see if BNB can crack the psychological barrier at $700 within the days forward.

Technical Evaluation Overview:

- BNB gained 2.77% over the 24-hour interval, signaling strong upward momentum, in keeping with CoinDesk Analysis’s technical evaluation mannequin.

- Value ranged $27.51 (4.11%) between a low of $667.61 and a excessive of $695.12.

- Buying and selling quantity spiked to 155,426 tokens on the shut of yesterday’s buying and selling, greater than double the 24-hour common of 64,169.

- Resistance is seen close to $695.12, whereas help has emerged round $667.61.

- After the preliminary rally, costs consolidated inside a slender $1.51 band from $688.81 to $690.73.

- Sturdy help has settled close to the $688.80-$689.00 zone.

- The market briefly examined resistance at $690.73 earlier than easing again in a managed pullback.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.