The spot bitcoin exchange-traded funds (ETFs) raked in over $1 billion in inflows on Thursday, marking one among their strongest single-day totals since launch. The surge got here as bitcoin broke a brand new all-time excessive above $118,000.

Main the pack was BlackRock’s iShares Bitcoin Belief (IBIT), which crossed $80 billion in property beneath administration (AUM), making it the quickest ETF in historical past to hit that milestone. It took IBIT simply 374 days — roughly a fifth of the time it took the earlier record-holder, the Vanguard S&P 500 ETF (VOO), which reached the identical mark in 1,814 days, based on Bloomberg Intelligence senior ETF analyst Eric Balchunas.

IBIT now ranks because the twenty first largest ETF globally by property, a outstanding feat for a fund that launched simply over a 12 months in the past amid the broader approval of spot bitcoin ETFs within the U.S.

Thursday’s $1 billion influx marks solely the fourth time spot bitcoin ETFs have posted every day quantities that giant. The final time was in January as U.S. President Donald Trump took workplace. Earlier than that, it occurred twice in November 2024, shortly after the U.S. election.

The surge in curiosity displays rising investor urge for food for direct bitcoin publicity in conventional brokerage accounts. Spot bitcoin ETFs supply a better on-ramp for institutional and retail buyers alike, who could also be cautious of custody and compliance points within the crypto area.

President Trump’s Media firm has just lately filed for an additional spot bitcoin ETF beneath the Reality Social model that has but to obtain approval from the Securities and Alternate Fee.

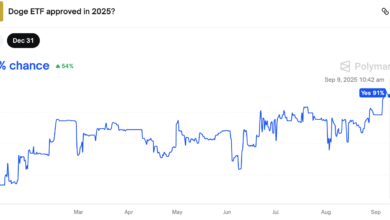

A variety of different ETFs monitoring the value of Solana

, XRP and others have additionally but to get the inexperienced gentle from the regulator.