- The US Greenback good points power on Friday, lifted by US President Trump’s renewed tariff threats and fading expectations of near-term Fed rate of interest cuts.

- Trump targets Canada with a 35% tariff, citing fentanyl issues and commerce imbalances.

- The DXY hovers beneath key resistance at 97.80–98.00, with value supported by the 9-day EMA at 97.50

The US Greenback good points power on Friday, supported by renewed tariff threats from US President Donald Trump, which have reignited international commerce tensions and sparked a brand new wave of threat aversion. As tensions escalate, buyers have gotten more and more cautious, favoring the Buck’s standing as a protected haven. This shift in sentiment has pushed the US Greenback Index (DXY) greater, as markets put together for potential financial coverage modifications.

The US Greenback Index (DXY), which measures the worth of the Buck in opposition to a basket of main currencies, is rising forward of the American session. As of now, the index is buying and selling close to 97.84, up round 0.20% on the day, although it faces a confluence of key technical obstacles.

US President Donald Trump has escalated tariff tensions this week by sending warning letters to greater than 20 international locations, together with main buying and selling companions comparable to Canada, Japan and South Korea, in addition to threatening smaller economies with tariffs starting from 15% to as excessive as 50%, primarily based on every nation’s commerce relationship with the US (US). The letters, shared on Trump’s social media platform Fact Social, replicate his powerful stance on commerce and are a warning that the US will impose broad “reciprocal” tariffs until buying and selling companions comply with extra favorable phrases.

As a part of the most recent push, Trump introduced a 35% tariff on Canadian imports, efficient on August 1. In an official letter to Canadian Prime Minister Mark Carney, the American president cited Canada’s alleged failure to forestall the move of fentanyl into the US, in addition to long-standing commerce imbalances and excessive tariffs on US dairy exports. The doc warned that any retaliatory tariffs imposed by Canada can be met with equal further levies, along with the 35%. Trump additionally emphasised that items transshipped by way of Canada to bypass the duties can be topic to the upper fee, until they’re manufactured inside the US.

Moreover, the US president has signaled that every one remaining buying and selling companions who haven’t but obtained particular tariff letters or finalized commerce agreements will probably be hit with blanket tariffs of 15% or 20%. Trump additionally added some international locations may be excused if they comply with higher offers. Economists warn that such sweeping measures might enhance import prices, stoke inflation and provoke retaliatory actions, making international commerce negotiations extra fraught within the months forward.

Market Movers: Treasury Yields regular, Fed cautious on tariff fallout

- USD/CAD rallied by practically 0.5% to a excessive of 1.3731 earlier than easing beneath the 1.3700 mark, following President Trump’s announcement of recent tariffs on Canadian imports. A US official later clarified that the 35% tariffs will apply solely to items not coated beneath the United States-Mexico-Canada Settlement (USMCA). The newest tariff transfer seems to be a strategic strain tactic geared toward pushing Canada towards finalizing a revised commerce take care of the US forward of the July 21 deadline. This deadline was set by Canadian Prime Minister Mark Carney after a gathering with Trump on the G7 Summit in Canada in mid-June. It was framed as a 30-day timeline to barter a brand new financial and safety relationship.

- The yield on the 10-year US Treasury notice stabilized round 4.36% on Friday, capping a risky week marked by heightened commerce tensions and shifting expectations round Federal Reserve financial coverage. Investor sentiment remained cautious, with Treasury-focused ETFs seeing a pointy rise in inflows, signaling elevated demand for safe-haven belongings. The firming in long-term yields displays a guarded financial outlook and should play a key position in shaping the near-term path of the US Greenback.

- With expectations of Federal Reserve (Fed) rate of interest cuts fading, the US Greenback continues to attract help, bolstered additional by current indicators of power within the US labor market. Weekly Preliminary Jobless Claims got here in beneath expectations for the third consecutive week, reinforcing the view that the financial system stays resilient.

- Talking on Thursday, Fed officers urged that new tariffs could not result in a pointy rise in shopper costs. San Francisco Fed President Mary Daly famous that tariffs “simply don’t materialize to a big enhance in value inflation for shoppers as a result of the companies discover methods to regulate.” Echoing this view, Chicago Fed President Austan Goolsbee mentioned the influence on inflation has thus far been “surprisingly little,” indicating that pricing pressures could stay contained at the same time as commerce tensions escalate.

- Additionally on Thursday, Fed Governor Christopher Waller reaffirmed his help for a July fee reduce, stating that “inflation has come down far sufficient to justify a transfer – and tariffs mustn’t essentially be a motive to delay.” In the meantime, St. Louis Fed President Alberto Musalem mentioned, “It’s going to take time for the tariffs to settle. We could possibly be in This autumn this 12 months, or Q1 or Q2 of subsequent 12 months, the place tariffs are nonetheless working themselves into the financial system.”

- Total, the strong US financial backdrop provides the Fed time to evaluate the influence of current tariff bulletins on inflation and development earlier than continuing with additional fee cuts. In line with the CME FedWatch Device, markets are pricing in solely a 6.7% likelihood of a 25-basis-point rate of interest reduce in July, a 62.2% likelihood of a reduce in September, factoring in roughly 100 foundation factors of complete easing over the subsequent 12 months.

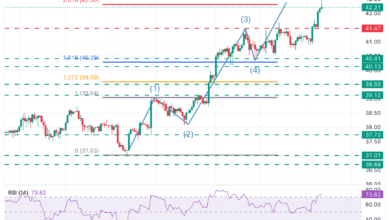

Technical Evaluation: US Greenback Index consolidates beneath 98.00, technical breakout looms

The US Greenback Index (DXY) is buying and selling close to 97.84 on Friday, with modest good points because it approaches a key technical zone. The index is hovering slightly below the 21-day Exponential Transferring Common (EMA), at present at 97.77, which aligns with the higher boundary of a falling wedge sample and the 97.80-98.00 zone — a former help space now appearing as resistance. This confluence kinds a vital short-term barrier. A decisive break above this stage might affirm a bullish reversal, opening the door towards 98.50, close to the June 24 excessive.

On the draw back, the 9-day EMA is appearing as short-term dynamic help close to 97.50, serving to to cushion current pullbacks. This stage has constantly held over the three days, limiting draw back strain because the US Greenback consolidates inside a tightening vary.

Momentum indicators are exhibiting early indicators of restoration, with the Relative Energy Index (RSI) climbing to 47.12, although nonetheless beneath the impartial 50 stage, suggesting momentum stays in growth. The Common Directional Index (ADX) at 13.2 displays a weak total development, indicating {that a} clear directional breakout has but to materialize. Whereas the broader setup seems cautiously constructive, bulls want a robust day by day shut above 98.00 to verify sustained upside potential.

US Greenback PRICE As we speak

The desk beneath exhibits the proportion change of US Greenback (USD) in opposition to listed main currencies as we speak. US Greenback was the strongest in opposition to the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.13% | 0.55% | 0.56% | 0.31% | 0.17% | 0.46% | -0.04% | |

| EUR | -0.13% | 0.41% | 0.45% | 0.17% | 0.12% | 0.31% | -0.16% | |

| GBP | -0.55% | -0.41% | 0.04% | -0.25% | -0.29% | -0.02% | -0.60% | |

| JPY | -0.56% | -0.45% | -0.04% | -0.24% | -0.39% | -0.13% | -0.62% | |

| CAD | -0.31% | -0.17% | 0.25% | 0.24% | -0.08% | 0.13% | -0.36% | |

| AUD | -0.17% | -0.12% | 0.29% | 0.39% | 0.08% | 0.35% | -0.29% | |

| NZD | -0.46% | -0.31% | 0.02% | 0.13% | -0.13% | -0.35% | -0.54% | |

| CHF | 0.04% | 0.16% | 0.60% | 0.62% | 0.36% | 0.29% | 0.54% |

The warmth map exhibits share modifications of main currencies in opposition to one another. The bottom forex is picked from the left column, whereas the quote forex is picked from the highest row. For instance, should you choose the US Greenback from the left column and transfer alongside the horizontal line to the Japanese Yen, the proportion change displayed within the field will characterize USD (base)/JPY (quote).