- The Canadian Greenback (CAD) rebounded after hitting a two-week low, following upbeat home labour market information.

- Canada added 83,100 jobs in June, sharply above expectations, whereas the Unemployment Fee ticked down to six.9%.

- Trump targets Canada with 35% tariff beginning August 1, citing fentanyl issues and commerce imbalances.

- Canadian PM Mark Carney defended Ottawa’s stance and vowed to guard Canadian employees and companies.

The Canadian Greenback (CAD) regains floor in opposition to the US Greenback (USD) on Friday, marking a two-week low in the course of the early Asian buying and selling session after US President Donald Trump introduced a steep 35% tariff on Canadian imports, set to take impact on August 1.

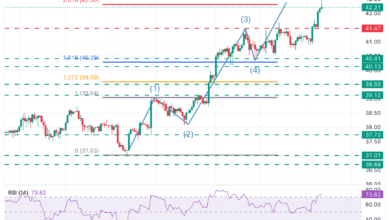

Whereas the preliminary response triggered a pointy sell-off within the Loonie, with USD/CAD surging to a day by day excessive of 1.3730. Nonetheless, the pair has since pulled again, buying and selling round 1.3675 in the course of the American session, because the Canadian Greenback finds help from stronger-than-expected home labour market information.

Canada’s labour market delivered a sturdy upside shock in June, offering contemporary help to the Canadian Greenback following a turbulent begin to the day. Statistics Canada reported on Friday that the Unemployment Fee ticked down to six.9%, defying market expectations for a rise of seven.1%. The Web Change in Employment surged to 83,100, a pointy acceleration from Might’s modest 8,800 acquire and effectively above forecasts.

The Labour Power Participation Fee additionally edged larger to 65.4% from 65.3%, signaling a slight improve in workforce engagement. Nonetheless, Common Hourly Wages eased to three.2% year-over-year, down from 3.5% within the earlier month, pointing to some cooling in wage-driven inflation pressures.

On the commerce entrance, the aggressive measures introduced by President Trump have reignited fears of a renewed commerce battle, significantly as they aim an in depth United States–Mexico–Canada Settlement (USMCA) companion. In an official letter shared through his Reality Social platform, Trump justified the 35% tariff by accusing Canada of failing to stem fentanyl trafficking and implementing “unfair commerce obstacles” on American dairy and agricultural exports. He claimed the transfer was essential to “rebalance” the US$63 billion commerce deficit with Canada and shield American employees, farmers, and producers.

Trump warned that any retaliatory motion from Ottawa can be met with even steeper tariffs, signaling a probably risky and extended disruption to US-Canada commerce relations. Notably, the brand new tariffs will apply to a variety of Canadian items not protected below USMCA phrases. In his letter to Canadian Prime Minister Mark Carney, Trump additionally emphasised that Canadian corporations relocating operations to the USA would obtain expedited regulatory therapy. “We’ll do all the pieces potential to get approvals rapidly, professionally, and routinely — in different phrases, in a matter of weeks,” he wrote.

In response, Canadian Prime Minister Mark Carney defended Canada’s commerce insurance policies and efforts to fight illicit drug trafficking. In a submit on X, Carney acknowledged, “All through the present commerce negotiations with the USA, the Canadian authorities has steadfastly defended our employees and companies. We’ll proceed to take action as we work in the direction of the revised deadline of August 1.” His remarks replicate Ottawa’s agency stance in opposition to what it sees as unjustified protectionist measures, reinforcing its dedication to safeguarding nationwide pursuits amid intensifying strain from Washington.

Canadian Greenback PRICE In the present day

The desk under exhibits the proportion change of Canadian Greenback (CAD) in opposition to listed main currencies right now. Canadian Greenback was the strongest in opposition to the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.11% | 0.56% | 0.50% | 0.16% | 0.08% | 0.37% | -0.04% | |

| EUR | -0.11% | 0.43% | 0.40% | 0.03% | 0.03% | 0.24% | -0.16% | |

| GBP | -0.56% | -0.43% | -0.02% | -0.40% | -0.39% | -0.14% | -0.61% | |

| JPY | -0.50% | -0.40% | 0.02% | -0.35% | -0.45% | -0.17% | -0.58% | |

| CAD | -0.16% | -0.03% | 0.40% | 0.35% | -0.03% | 0.20% | -0.21% | |

| AUD | -0.08% | -0.03% | 0.39% | 0.45% | 0.03% | 0.36% | -0.19% | |

| NZD | -0.37% | -0.24% | 0.14% | 0.17% | -0.20% | -0.36% | -0.46% | |

| CHF | 0.04% | 0.16% | 0.61% | 0.58% | 0.21% | 0.19% | 0.46% |

The warmth map exhibits proportion modifications of main currencies in opposition to one another. The bottom foreign money is picked from the left column, whereas the quote foreign money is picked from the highest row. For instance, in case you decide the Canadian Greenback from the left column and transfer alongside the horizontal line to the US Greenback, the proportion change displayed within the field will signify CAD (base)/USD (quote).