The greenback worth locked in open XRP choices contracts listed on Deribit is quickly climbing to a document because the token’s excessive implied volatility attracts yield hunters.

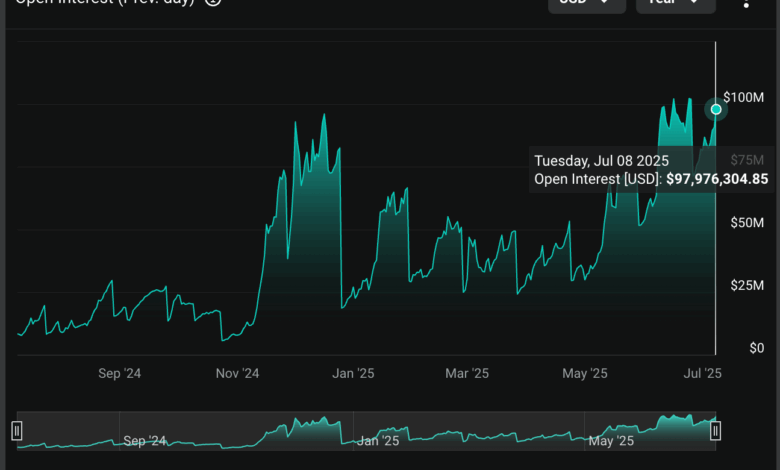

The so-called notional open curiosity (OI) has risen to almost $98 million from $71 million because the June 27 quarterly expiry, a strong 38% rise in two weeks. It’s now nearing the June 24 document of $102.3 million, in keeping with knowledge supply Deribit Metrics. In contract phrases, the OI has elevated by 26% to 42,414. (The contract multiplier for XRP on Deribit is 1,000 XRP).

Behind the rise is the token’s implied volatility, a measure of anticipated worth swings over a particular interval. XRP’s is increased than bitcoin

, ether and solana , in keeping with Lin Chen, Deribit’s head of Asia enterprise growth.

“XRP has delivered an annual return of over 300% over the previous 12 months,” Chen advised CoinDesk. “Its choices have additionally gained vital recognition, mirrored within the highest implied volatility amongst main tokens — indicating sturdy investor demand.”

A method merchants are making features is by promoting cash-secured places, Chen mentioned. Writing a put choice — agreeing to purchase the asset at a set worth — is akin to promoting insurance coverage towards worth drops in return for a premium, which represents the vendor’s return.

Merchants sometimes write choices towards holdings within the spot market or in a “cash-secured” manner when the implied volatility is excessive. The upper the volatility, the dearer the choices and vice versa. The cash-secured model entails holding sufficient stablecoins to make sure the underlying asset could be purchased if the value slides and the put purchaser decides to train their proper to promote the asset on the predetermined worth.

Danger reversals are skewed bullish

As of the time of writing, the 25-delta threat reversals have been optimistic, indicating a bias towards name choices, or bullish bets, in keeping with knowledge tracked by Amberdata.

The 25-delta threat reversal is a method that includes a protracted put place and a brief name choice (or vice versa) with a 25% delta, which means each choices are comparatively removed from the underlying asset’s present market worth.

The pricing for threat reversals throughout tenors helps determine market sentiment, with optimistic values representing a relative richness of calls and adverse values indicating a draw back bias. At press time, short-term XRP threat reversals and people tied to August and September expiries have been optimistic.

Moreover, greater than 30 million calls have been open, outstripping 11.92 million places, giving a put-call ratio of 0.39, additionally an indication of bullish sentiment available in the market.

Disclaimer: Elements of this text have been generated with the help from AI instruments and reviewed by our editorial crew to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.