- EUR/CHF edges decrease towards key assist zone at 0.9300.

- ECB’s Lane warns of rising dangers past tariffs, together with capital controls and security-related commerce obstacles.

- Technical indicators replicate a fading bullish momentum because the RSI eases under 50 and the MACD histogram deepens into the pink.

The Euro (EUR) weakens in opposition to the Swiss Franc (CHF) on Wednesday, with EUR/CHF buying and selling close to the decrease boundary of its multi-week vary round 0.9318. The cross stays underneath strain following recent feedback from European Central Financial institution (ECB) officers that added to the cautious temper across the Euro.

Earlier in the present day, ECB Chief Economist Philip Lane flagged an evolving set of world dangers that stretch past tariffs, highlighting non-tariff commerce obstacles, capital move restrictions, and the growing overlap between safety and financial coverage. In the meantime, ECB Deputy Director-Normal Livio Stracca issued a stark warning that climate-related shocks might wipe out as a lot as 5% of eurozone GDP over the subsequent 5 years, comparable in scale to the COVID-19 disaster. These feedback reinforce the ECB’s cautious coverage stance and will hold investor urge for food for the Euro muted, in opposition to defensive currencies just like the Swiss Franc.

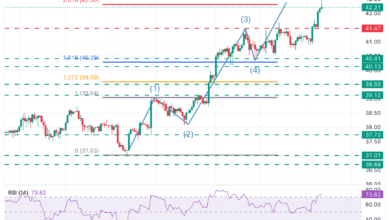

From a technical perspective, EUR/CHF stays trapped in a decent sideways vary between 0.9300 and 0.9430 since late April. Nonetheless, in the present day’s decline places the cross prone to breaking under the 0.9300 psychological assist zone.

The pair is buying and selling simply beneath the 20-day Easy Shifting Common (SMA) close to 0.9365, which additionally serves as the center line of the Bollinger Bands, reinforcing its position as instant resistance. The shortcoming to reclaim this stage alerts a scarcity of bullish bias, particularly as the worth continues to hover close to the decrease Bollinger Band, indicating downward strain.

Momentum indicators are skewed in favor of the bears. The Relative Energy Index (RSI) is slipping towards the 40 mark, indicating weakening shopping for curiosity and an growing threat of a bearish continuation. On the similar time, the Shifting Common Convergence Divergence (MACD) has turned damaging, with the MACD line now comfortably under the sign line and the histogram extending into pink territory, indicating fading bullish momentum.

A sustained break under 0.9300 would seemingly affirm a bearish breakout from the latest vary and will speed up draw back towards the April swing low at 0.9223, adopted by the psychological 0.9200 stage. On the flip aspect, any restoration try would want to clear the 20-day SMA close to 0.9365 to shift the short-term bias again towards impartial. Till then, the trail of least resistance seems tilted to the draw back.