Donald Trump Jr., the eldest son of the US president, disclosed an funding in Thumzup Media Corp, a social media advertising firm that has adopted the Bitcoin (BTC) treasury technique.

Trump Jr. presently holds 350,000 shares of the corporate, valued at practically $3.3 million, in accordance with Bloomberg, and the inventory is presently buying and selling arms at roughly $9.50 per share.

The corporate’s board of administrators authorized the usage of Bitcoin as a company treasury asset in November 2024 by green-lighting the acquisition of as much as $1 million in BTC. Firm CEO Robert Steele stated following the choice:

“With the newly sanctioned Bitcoin ETFs and rising backing from institutional buyers, Bitcoin presents a robust addition to our treasury method. Its finite provide and inflation-resistant qualities improve its position as a dependable asset for preserving worth.”

In Might, the corporate additionally filed a common shelf registration with america Securities and Trade Fee (SEC) to boost $200 million by way of company debt and fairness to finance additional Bitcoin acquisitions.

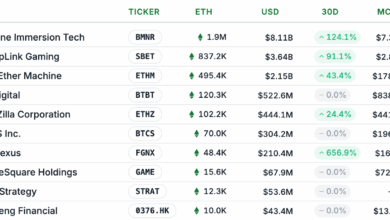

Thumzup presently holds 19.11 BTC, valued at over $2.1 million, in accordance with knowledge from BitcoinTreasuries, which it started accumulating in January.

The proliferation of Bitcoin treasury corporations since 2024 has led some analysts to take a position on the sustainability of the company treasury mannequin and whether or not these establishments are right here to remain or will fizzle out, igniting the following extended bear market.

Associated: Trump-linked American Bitcoin raises $220M for mining, treasury

Analysts and BTC maxis solid doubt on Technique copycats

Technique co-founder Michael Saylor popularized the Bitcoin treasury idea after reorienting the enterprise intelligence software program firm right into a Bitcoin treasury firm in 2020.

Since that point, 258 establishments have adopted Bitcoin as a part of their company reserves, together with asset managers, public corporations, non-public corporations, crypto custodians and authorities organizations, in accordance with BitcoinTreasuries.

Nonetheless, some analysts argue that the pattern is unsustainable and that most of the Technique copycats will fail as a consequence of an absence of conviction within the supply-capped digital asset.

Bitcoin maximalist Max Keiser stated that Saylor and his firm have been battle-tested, weathering earlier bear markets and persevering with accumulation by way of market cycles, in contrast to newer treasury corporations that haven’t confronted a market downturn.

A report from enterprise capital agency Breed, printed in June, echoed Keiser’s place that the majority Bitcoin treasury corporations is not going to survive and shall be compelled right into a loss of life spiral as soon as BTC costs start to say no.

Journal: I grew to become an Ordinals RBF sniper to get wealthy… however I misplaced most of my Bitcoin