Hester Peirce, head of the US Securities and Alternate Fee’s (SEC) Crypto Activity Pressure, stated that placing securities on a blockchain “doesn’t have magical skills to rework the character of the underlying asset.”

In a July 9 assertion, Peirce emphasised that tokenized shares, notes, or entitlements “are nonetheless securities,” requiring issuers, intermediaries, and merchants to stick to present federal regulation when creating, promoting, or transferring them.

Authorized obligations

Peirce’s bulletin notes that tokenization can happen in two methods: an issuer can mint blockchain variations of its personal shares, or a custodian can wrap third-party securities and concern receipts.

She warned that the second mannequin introduces counterparty threat as a result of the token holder will depend on the custodian’s solvency and management of the underlying shares.

Peirce urged distributors to seek the advice of the SEC’s Division of Company Finance’s “employees assertion” on disclosure duties and to fulfill with company employees early in the event that they search bespoke exemptions.

She additionally flagged that the principles would possibly classify particular token codecs as “receipts for a safety” or, in the event that they lack useful possession rights, as “security-based swaps” barred from off-exchange retail buying and selling.

Peirce wrote:

“The identical authorized necessities apply to on- and off-chain variations of those devices.”

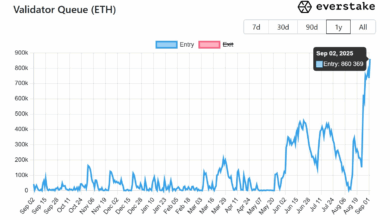

Rising on-chain inventory exercise

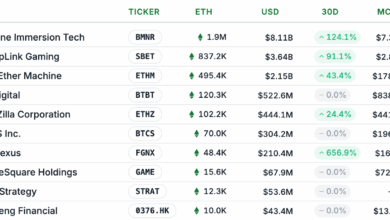

Peirce’s remarks arrive as tokenized fairness volumes speed up. Solana-based inventory tokens issued underneath Backed Finance’s xStocks framework reached a mixed market worth of $48.53 million as of July 4.

Dashboard snapshots from information supplier RWA.xyz present that the overall surpassed the $50 million mark on July 6.

Moreover, xStocks is now shifting to different venues. BNB Chain introduced that it’ll checklist Apple, Tesla, and different fairness tokens as BEP-20 belongings in partnership with Kraken and Backed, offering customers with 24-hour entry and DeFi composability.

Market individuals largely welcomed the readability. Backed Finance co-founder Adam Levi stated in an announcement that the corporate “designed xStocks to reflect conventional fairness custody so regulatory therapy stays simple.”

Kraken added that DeFi integrations on BNB Chain will let customers publish tokenized shares as collateral with out altering their securities standing.

Individually, Bitget built-in xStocks into its on-chain platform on July 9, enabling prospects to commerce the identical tokens from their spot accounts with out the necessity for separate wallets.

Peirce closed by signaling openness to modernization, saying the Fee “stands able to work with market individuals to craft acceptable exemptions and modernize guidelines” the place know-how exposes gaps.