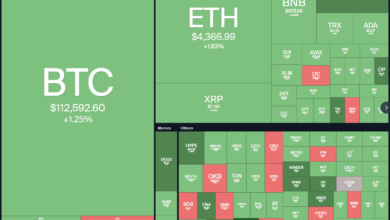

Bitcoin hit new highs as US debt rose to $36.6 trillion. Will macroeconomic information element the BTC rally?

Key takeaways:

-

Exploding US debt and housing market stress might set off a pointy BTC correction towards $95,000.

-

Bitcoin’s value stays intently tied to macro traits, together with Fed coverage and institutional flows.

The US’ gross nationwide debt elevated by $367 billion on Monday, reaching an all-time excessive of $36.6 trillion. The surge adopted US President Donald Trump’s approval of the “One Huge Stunning Invoice,” which raised the debt ceiling by $5 trillion on Friday. Might this be the set off for a Bitcoin (BTC) crash to $95,000?

Analysts, together with Kurt S. Altrichter, CRPS and founding father of Ivory Hill Wealth, have raised crimson flags in regards to the US housing market. A strong metric that usually spikes throughout previous financial downturns has now reached alarming ranges, in line with Altrichter.

The stock of recent single-family houses is approaching 10 months’ price of provide. In keeping with Altrichter, this “has solely occurred throughout or proper earlier than recessions.” He asserts that the weak point in housing stems from excessive rates of interest however, extra importantly, from what he calls “demand evaporation.”

If this historic sample—linking housing oversupply to broader financial decline—holds true, the influence might weigh on risk-on property, together with Bitcoin. Even when the long-term impact proves constructive for crypto, the fast response from traders tends to be threat aversion, favoring money and short-term bonds.

Jack Mallers, co-founder and CEO of Strike, famous on X that the one viable possibility for the US Treasury is to develop the financial base—an motion akin to printing cash. Mallers argues that the federal government is unlikely to default on its debt, that means debasement turns into the ultimate resort. This, he suggests, creates a perfect atmosphere for a Bitcoin rally.

Bitcoin’s destiny depends upon the US Federal Reserve’s actions

There’s additionally a counter-narrative: some market individuals consider Bitcoin’s breakout above $112,100 on Wednesday is unrelated to fiscal points or recession fears. As a substitute, they attribute the broader inventory market rally to expectations of coverage shifts on the Federal Reserve.

Hypothesis can be rising round President Trump’s potential push to interchange Fed Chair Jerome Powell. If profitable, the transfer might result in extra dovish financial coverage. Trump has repeatedly urged the Fed to decrease rates of interest. In keeping with Fox Enterprise, he’s at present vetting candidates to succeed Powell, whose time period ends in Might 2026.

Regardless of sturdy internet inflows into Bitcoin exchange-traded funds (ETFs) and rising institutional demand, BTC stays intently tied to broader fairness markets.

The correlation between Bitcoin and the S&P 500 stands at 68%, that means each asset lessons have offered related value traits. The continued US import tariffs are one other threat issue, doubtlessly hurting company earnings, particularly within the tech sector, which is closely reliant on world commerce.

Associated: Bitcoin information factors to rally to $120K after professional BTC merchants abandon their bearish bets

Nvidia (NVDA), which grew to become the world’s most beneficial firm with a $4 trillion market cap on Wednesday, may very well be significantly uncovered. It’s tough to foretell whether or not escalating commerce tensions will spark a steep decline in tech shares. Whereas elevating the debt ceiling typically boosts risk-on sentiment, the specter of a recession might set off a Bitcoin correction to $95,000.

In the end, a brand new all-time excessive for Bitcoin in 2025 stays believable, as famous by Strike’s Jack Mallers. However for now, merchants seem to concern whether or not the AI-driven tech sector will climate the commerce battle.

This text is for common info functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed below are the creator’s alone and don’t essentially mirror or symbolize the views and opinions of Cointelegraph.