As we speak in crypto, Japanese agency Metaplanet mentioned it plans to ultimately use its Bitcoin reserves to accumulate cash-generating companies, Coinbase’s foyer arm has urged lawmakers to expedite the CLARITY Act, which shifts crypto regulatory jurisdiction to the Commodity Futures Buying and selling Fee, and a US court docket has ended Coin Middle’s attraction in opposition to the Treasury Division over Twister Money.

Metaplanet eyes digital financial institution acquisition in section 2 of Bitcoin technique

Japanese agency Metaplanet plans to ultimately use its Bitcoin reserves to accumulate cash-generating companies, probably together with a digital financial institution in Japan.

In a latest interview with the Monetary Occasions, CEO Simon Gerovich mentioned the corporate is racing to build up as a lot Bitcoin (BTC) as attainable earlier than turning its holdings into leverage for growth.

“We consider it as a Bitcoin gold rush,” Gerovich mentioned. “We have to accumulate as a lot Bitcoin as we are able to… to get to some extent the place we’ve reached escape velocity and it simply makes it very tough for others to catch up.”

The Tokyo-listed agency, initially a resort operator, began accumulating Bitcoin as a hedge in opposition to inflation in 2024. It presently holds 15,555 BTC and goals to spice up that determine to over 210,000 by 2027, 1% of all Bitcoin that may ever exist.

Section two of Metaplanet’s plan entails utilizing Bitcoin as collateral to entry financing, just like securities or authorities bonds. “We’ll get money that we are able to use to purchase worthwhile companies,” Gerovich mentioned.

Gerovich mentioned Metaplanet’s future acquisitions would ideally align with its technique, so “possibly it’s buying a digital financial institution in Japan and offering digital banking providers which are superior to the providers that retail now could be getting.”

Coinbase crypto foyer urges Congress to again main crypto invoice

Coinbase’s lobbying arm, together with 65 crypto companies, has urged US Home lawmakers to go a serious invoice once they meet subsequent week that might lay out how the crypto trade is regulated.

In a letter despatched on Monday, Stand With Crypto and 65 crypto advocacy teams and companies requested Home lawmakers to again the Digital Asset Market Readability Act — higher often known as the CLARITY Act.

“We all know that there have been efforts to politicize crypto laws, however with crypto drastically reshaping the worldwide economic system the U.S. dangers falling behind except we undertake pro-crypto insurance policies that absolutely embrace blockchain expertise,” it mentioned.

The CLARITY Act specifies the roles of the Commodity Futures Buying and selling Fee and the Securities and Trade Fee in policing crypto. It offers many of the jurisdiction over crypto to the CFTC, however the SEC would regulate merchandise reminiscent of crypto-related securities.

Courtroom ends Coin Middle-US Treasury attraction over Twister Money

The US Courtroom of Appeals for the Eleventh Circuit has dismissed an attraction filed by crypto advocacy group Coin Middle in opposition to the US Treasury Division over its Workplace of International Property Management’s 2022 sanctions in opposition to the Twister Money mixing service.

In a Thursday submitting, the appellate court docket granted a movement to vacate a decrease court docket ruling and remand with directions to dismiss as a part of a joint submitting with Coin Middle and the US Treasury. The dismissal, in accordance with the court docket, would primarily conclude Coin Middle’s authorized problem in opposition to the Treasury’s Workplace of International Property Management (OFAC).

In 2022, OFAC added a number of pockets addresses related to Twister Money to its listing of sanctioned entities. Coin Middle filed a lawsuit alleging that the Treasury Division “exceeded [its] statutory authority” within the sanctions, although there have been different lawsuits filed by events, together with one from six Twister Money customers backed by crypto trade Coinbase.

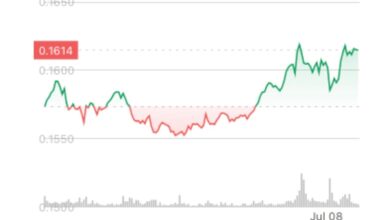

The worth of Twister Money’s native token (TORN) briefly surged by greater than 14% to $10.55 on the information on Monday, earlier than retracing to commerce at $9.47 on the time of publication.

“That is the official finish to our court docket battle over the statutory authority behind the [Tornado Cash] sanctions,” mentioned Coin Middle government director Peter Van Valkenburgh in a Monday X submit. “The federal government was not serious about transferring ahead and defending their dangerously overbroad interpretation of sanctions legal guidelines.”