Based on Glassnode, long-term holders (LTHs) are outlined as traders who’ve held bitcoin

for not less than 155 days. CoinDesk Analysis signifies that one motive bitcoin has ye to succeed in new all-time highs has been promoting stress from these long-term holders.

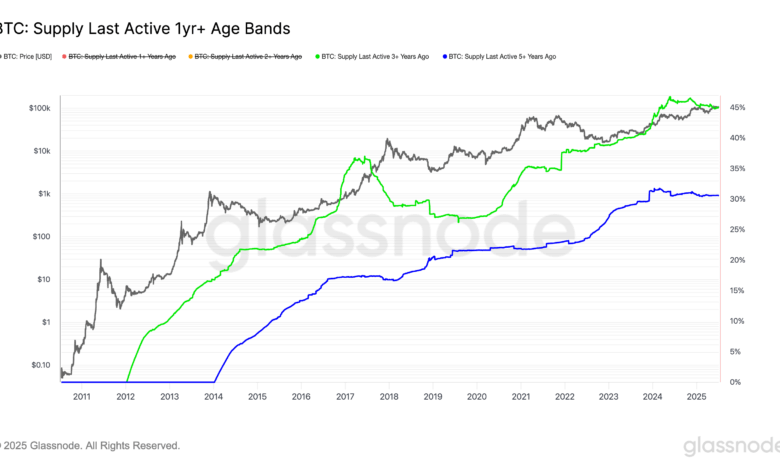

Nevertheless, zooming out, Glassnode knowledge exhibits that the proportion of bitcoin’s circulating provide that has not moved in not less than three years presently stands at 45%, which is identical degree noticed in February 2024, one month after the launch of the US exchange-traded fund.

Three years in the past, in July 2022, the market was within the midst of the leverage disaster triggered by the collapse of 3AC and Celsius over the last bear market, when bitcoin was priced at $20,000, which exhibits the conviction of LTHs.

In the meantime, the share of circulating provide that has not moved in not less than 5 years is at 30% and has remained flat since Might 2024.

So, regardless that long-term holders are promoting, as they sometimes do when costs climb increased, these knowledge factors recommend that the broader cohort has not considerably modified its mixture habits for over a yr now, implying that many are ready for increased costs earlier than making additional strikes.

Learn extra: Bitcoin Whales Wake Up From 14-12 months Slumber to Transfer Over $2B of BTC