Solana ($SOL) Positive aspects Institutional Traction as Japanese Financial institution Explores Stablecoin Funds

Solana

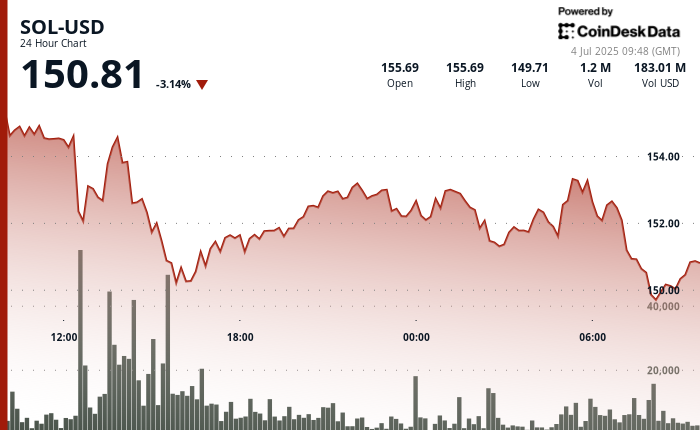

declined 3.36% over the previous 24 hours, retreating from $155.69 to $150.81, in line with CoinDesk Analysis’s technical evaluation mannequin, amid broader market pressures, at the same time as institutional developments in Asia sign rising momentum for the blockchain,

One in every of Japan’s most digitally progressive banks has launched a brand new initiative that would develop real-world purposes for Solana’s infrastructure.

Minna Financial institution, a digital-native financial institution and a subsidiary of Fukuoka Monetary Group, introduced a brand new analysis collaboration with Fireblocks, Solana, and TIS to guage how stablecoins and Web3 wallets can reshape shopper finance in Japan. The joint research will give attention to use circumstances like funds, on-chain banking infrastructure, and person experiences tailor-made for the nation’s mobile-first inhabitants.

The partnership comes as stablecoins surpass $250 billion in market capitalization, drawing elevated curiosity from banks trying to modernize cross-border funds, deposits, and settlement processes. Fireblocks’ CEO, Michael Shaulov, emphasised that the challenge may unlock new efficiencies in how worth is transferred throughout the digital economic system.

Minna Financial institution’s buyer base is primarily between the ages of 15 and 39 —underserved by conventional banks — making it a primary candidate for testing stablecoin-based options. The financial institution’s method, which integrates monetary companies with every day spending patterns, displays its broader Banking-as-a-Service technique.

Though Solana’s worth continues to commerce under its latest highs, initiatives like this spotlight its enchantment as a platform for enterprise and fintech innovation. With the REX-Osprey Solana + Staking ETF lately launching and DeFi Growth Corp. increasing its SOL holdings, institutional confidence within the ecosystem seems undeterred by short-term volatility.

Technical Evaluation Highlights:

- SOL dropped 3.36% from $155.69 to $150.46 over the 24-hour interval from July 3 at 10:00 to July 4 at 09:00.P

- rice motion ranged between $155.79 and $149.13, indicating 4.28% intraday volatility.

- Resistance emerged at $153.77 through the July 4 05:00 hour on elevated quantity.

- Assist held agency at $149.13 through the 08:00 hour, with sturdy shopping for exercise.

- A restoration section started within the remaining 60 minutes, pushing SOL from $149.97 to $150.57, a 0.40% acquire.

- Worth fashioned a mini-uptrend with larger lows after breaking $150.20 resistance at 09:03.

- Quantity surged at 08:50 (24,245 items) and 09:15 (22,894 items), confirming upward momentum.

- SOL stabilized above $150.63 with low resistance within the quick path.

Disclaimer: Elements of this text have been generated with the help from AI instruments and reviewed by our editorial crew to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.