Key factors:

-

Bitcoin gained 38% when US President Trump signed a significant spending invoice in late 2020.

-

Doing so once more would put BTC/USD at $150,000 as Trump prepares to signal his “Huge Stunning Invoice” into legislation.

-

International liquidity traits proceed to favor BTC worth upside, however Bitcoin might peak first.

Bitcoin (BTC) might acquire almost 40% after US President Donald Trump indicators his “Huge Stunning Invoice” on Independence Day.

Crypto market individuals are eyeing swift BTC worth good points as Trump’s “large” spending invoice turns into actuality.

”Huge Stunning Invoice” sparks COVID-19 bull market comparisons

Bitcoin has traditionally reacted extraordinarily positively to indicators that US borrowing will improve. Donald Trump’s “Huge Stunning Invoice” may very well be no exception, as estimates see US nationwide debt exploding to $40 trillion in 2025.

“To place this into perspective, at the beginning of 2020, whole US debt stood at $23.2 trillion. This could mark a close to $17 TRILLION improve in 6 years,” buying and selling useful resource The Kobeissi Letter wrote in a part of a latest evaluation on the subject.

“By no means in historical past has the US borrowed even remotely close to the degrees we’re borrowing now. This can be a disaster.”

LIVE: With the Huge Stunning Invoice passing, nationwide debt is forecasted to achieve $40 TRILLION this yr

No finish in sight pic.twitter.com/9ZAWDIPGJt

— Kalshi (@Kalshi) July 3, 2025

Kobeissi referenced odds from prediction service Kalshi, which supplied the $40 trillion determine.

Prior to now, nonetheless, Bitcoin has loved the added threat that rising the US debt mountain implies.

As famous by crypto X commentators, together with YouTube account Crypto Rover, when Trump signed a COVID-19 spending invoice in late 2020, BTC/USD subsequently gained 38% in a matter of weeks.

If the identical worth motion have been to observe the Huge Stunning Invoice, Bitcoin would find yourself passing $150,000.

Bitcoin follows the cash

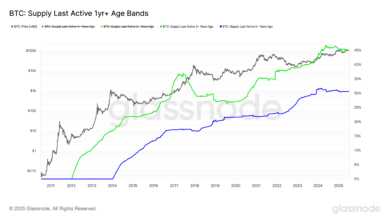

As Cointelegraph continues to report, bullish BTC worth bets are additionally being fueled by an increasing international M2 cash provide.

Associated: Bitcoin attributable to copy S&P 500 to hit new all-time excessive in July: Forecast

A transparent correlation has been evident all through Bitcoin’s historical past, with BTC/USD following M2 each up and down with a slight delay.

Unpopular #BTC opinion

International M2 will proceed to climb after Bitcoin has peaked in its Bull Market$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) June 16, 2025

This month, well-liked dealer and analyst Rekt Capital acknowledged that M2 can proceed rising even after Bitcoin sees a bull market blow-off high.

On July 3, international M2 hit a brand new all-time excessive of greater than $55.4 trillion.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.