AI-focused NEAR token halted its 10% rally on Thursday as merchants started to take income from a rally that was spurred by Bitwise’s announcement that it’s launching a NEAR trade traded product (ETP) in Germany.

“The NEAR Staking ETP on Xetra opens a brand new bridge to NEAR for establishments by offering a regulated, exchange-traded technique to earn staking rewards,” Illia Polosukhin informed CoinDesk. “Buyers achieve compliant entry to the NEAR ecosystem and user-owned AI without having to deal with non-public keys or node operations, and with full worth transparency.”

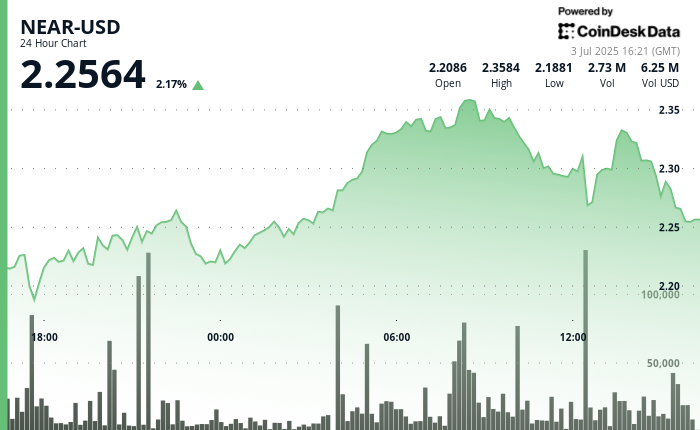

The token has now established a key stage of help at $2.26 because it appears to consolidate earlier than persevering with to the upside.

Technical evaluation

- NEAR established sturdy help at $2.26 with above-average quantity in the course of the 24-hour interval from 2 July 16:00 to three July 15:00.

- Value broke via the $2.30 resistance stage within the early hours of three July, reaching a brand new excessive at $2.36 in the course of the 08:00 hour with substantial quantity affirmation.

- The 23.6% Fibonacci retracement stage supplied help in the course of the profit-taking part, suggesting the underlying uptrend stays intact.

- Throughout the 60-minute interval from 3 July 14:50 to fifteen:49, NEAR skilled a steep sell-off at 15:04-15:07, the place quantity spiked to over 310,000 items.

- A brand new help zone has been established between $2.26-$2.27, with the closing worth of $2.26 suggesting continued bearish stress within the brief time period.

CoinDesk 20 Index Jumps 2% Earlier than Late Session Selloff

During the last 24 hours from 3 July 15:00 to 2 July 16:00, CD20 exhibited vital volatility with an general vary of $37.27 (2.11%), reaching a peak of $1,811.11 in the course of the 14:00 hour on 3 July earlier than sharply retracing to $1,791.50 by session shut.

The asset demonstrated outstanding energy in the course of the mid-session rally, gaining over $21 (1.18%) from its in a single day low of $1,778.85, with significantly aggressive shopping for momentum noticed in the course of the 09:00 and 13:00 hours that means institutional accumulation regardless of the late session profit-taking.