Solana’s on-chain fundamentals gained a serious vote of confidence on Thursday as Florida-based DeFi Growth Corp (DFDV) introduced it had expanded its SOL

treasury by buying 17,760 extra tokens. The acquisition, valued at roughly $2.72 million, was executed at a median worth of $153.10 per token. This transfer aligns with the corporate’s said long-term technique of compounding SOL holdings and staking rewards.

Following this acquisition, DeFi Dev Corp’s complete holdings reached 640,585 SOL and SOL equivalents, representing a U.S. greenback worth of round $98.1 million. Primarily based on the corporate’s final reported complete of 14,740,779 shares excellent, the present SOL-per-share (SPS) stands at 0.042, or roughly $6.65 per share utilizing the day’s worth knowledge.

All newly acquired SOL shall be staked with a wide range of validators, together with DeFi Dev Corp’s personal infrastructure on the Solana community. This strategy permits the corporate to earn native yield by way of staking rewards and validator charges, whereas immediately contributing to Solana’s decentralization and operational resilience.

DeFi Dev Corp has positioned itself as the primary public firm to make Solana the centerpiece of its treasury technique. Along with accumulating and staking SOL, additionally it is actively engaged in decentralized finance (DeFi) alternatives and ecosystem participation. The corporate’s treasury technique provides shareholders direct financial publicity to the token whereas supporting Solana’s application-layer improvement.

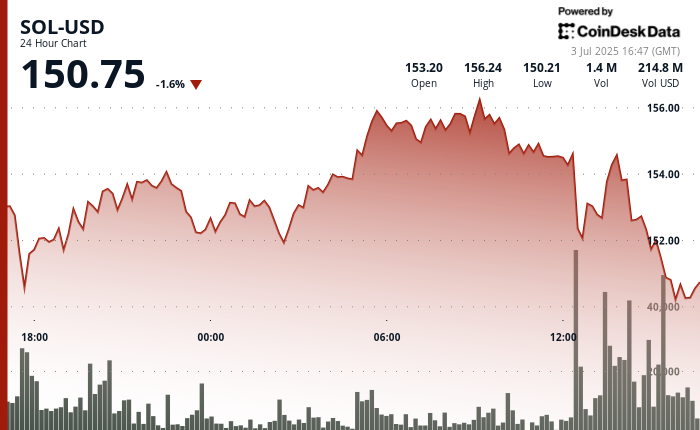

On the time of writing, SOL was buying and selling at round $150.75, down 1.6% prior to now 24-hour interval, in keeping with CoinDesk Analysis’s technical evaluation mannequin. In the meantime, the broader crypto market, as gauged by the CoinDesk 20 Index (CD20), is up 0.13% in the identical interval.

Technical Evaluation Highlights

- SOL ranged from $156.28 to $150.04 between July 2 17:00 and July 3 16:00, reflecting 4.15% volatility.

- Sturdy resistance shaped at $156 throughout early buying and selling hours, with above-average quantity triggering a reversal.

- Worth dropped under key assist at $152 in the course of the 12:00–15:00 interval, settling at $150.44.

- Within the remaining hour (15:16–16:15 UTC), SOL declined 0.63% from $151.85 to $150.89.

- A pointy selloff occurred at 15:35 UTC, with worth dropping to $150.44 on excessive quantity (213.6K).

- Help emerged at $150.35 with rising buy-side exercise and a modest restoration within the remaining minutes.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial staff to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.