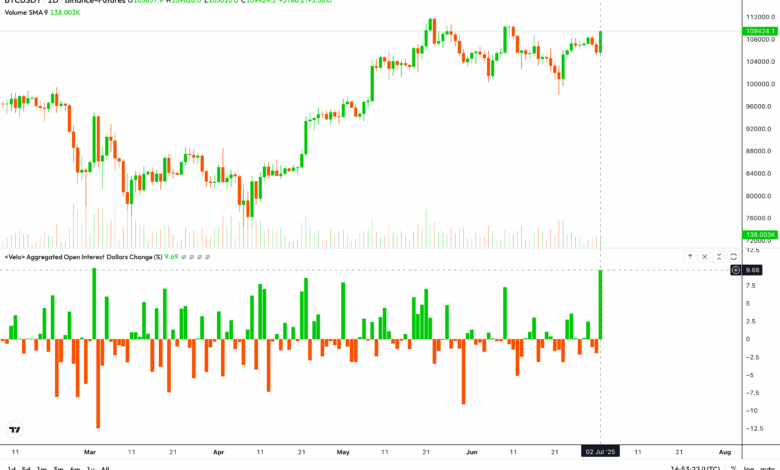

Open curiosity in bitcoin perpetual futures surged Wednesday by probably the most in 4 months because the main cryptocurrency neared the $110,000 mark.

Open curiosity in perpetual futures listed on offshore exchanges rose by almost 10% to $26.91 billion, the very best single-day enhance since March 2, in keeping with information supply Velo. The information monitoring web site included exercise in USD and USDT-denominated perpetuals listed on Binance, Bybit, OKX, Deribit, and Hyperliquid.

Open curiosity refers back to the variety of energetic or open contracts, typically expressed by way of their cumulative dollar-denominated worth.

An uptick in open curiosity alongside a worth rise is alleged to verify the uptrend. BTC’s worth surged over 3.5% to $109,600 as a consequence of a number of things, together with the disappointing U.S. ADP jobs report, which strengthened requires Fed fee cuts, Trump’s commerce cope with Vietnam, and the launch of the REX-Osprey Solana + Staking ETF (SSK).

Moreover, the perpetual funding charges of BTC and ETH rose barely from an annualized 5% to over 7%, suggesting renewed demand for leveraged bullish performs. Funding charges for DOGE and ADA topped the ten% mark.

BTC’s worth rally additionally led to a complete of $300 million in liquidations or compelled closure of leveraged futures performs as a consequence of margin shortages. A lot of the compelled closures have been bearish brief positions, in keeping with the information supply Coinglass.

A complete of 107,604 merchants have been liquidated previously 24 hours, with the biggest single order, price over $2.32 million, taking place on Hyperliquid.