Tech traders like to pay for potential. GameFi tokens, with sky-high valuations divorced from present person numbers or revenues, embody this optimism completely — as CoinDesk investigated in 2022, Decentraland’s then billion-dollar market cap did not fairly match the variety of energetic gamers on the platform.

However, surprisingly, distributed compute tokens do not appear to get pleasure from the identical speculative premium even when in comparison with their Conventional Finance traded friends like CoreWeave (CRWV).

CoinMarketCap says the class of tokens for decentralized networks that present GPU energy for AI and different compute workloads, which incorporates well-known tokens like BitTensor, Aethir, and Render, is value $12 billion.

On the identical time, market information from analysis group MarketsandMarkets places the worth of the GPU as a service business at round $8 billion this 12 months, rising to $26 billion in 2030.

In distinction, CRWV closed Monday in New York at $163, placing its market cap at $79.2 billion. The corporate’s current earnings forecast as much as $5.1 billion in 2025 income, suggesting it trades at greater than 15 occasions ahead gross sales.

That sort of a number of could be justified in a high-growth setting, however CoreWeave additionally posted a $314.6 million internet loss within the first quarter, pushed partially by stock-based compensation and continued infrastructure buildout.

Regardless of this, traders proceed to reward CoreWeave for its dominant place in centralized AI infrastructure with its refill 300% year-to-date. The corporate is tightly built-in with Nvidia and has excessive visibility by means of contracts with OpenAI and different enterprise shoppers.

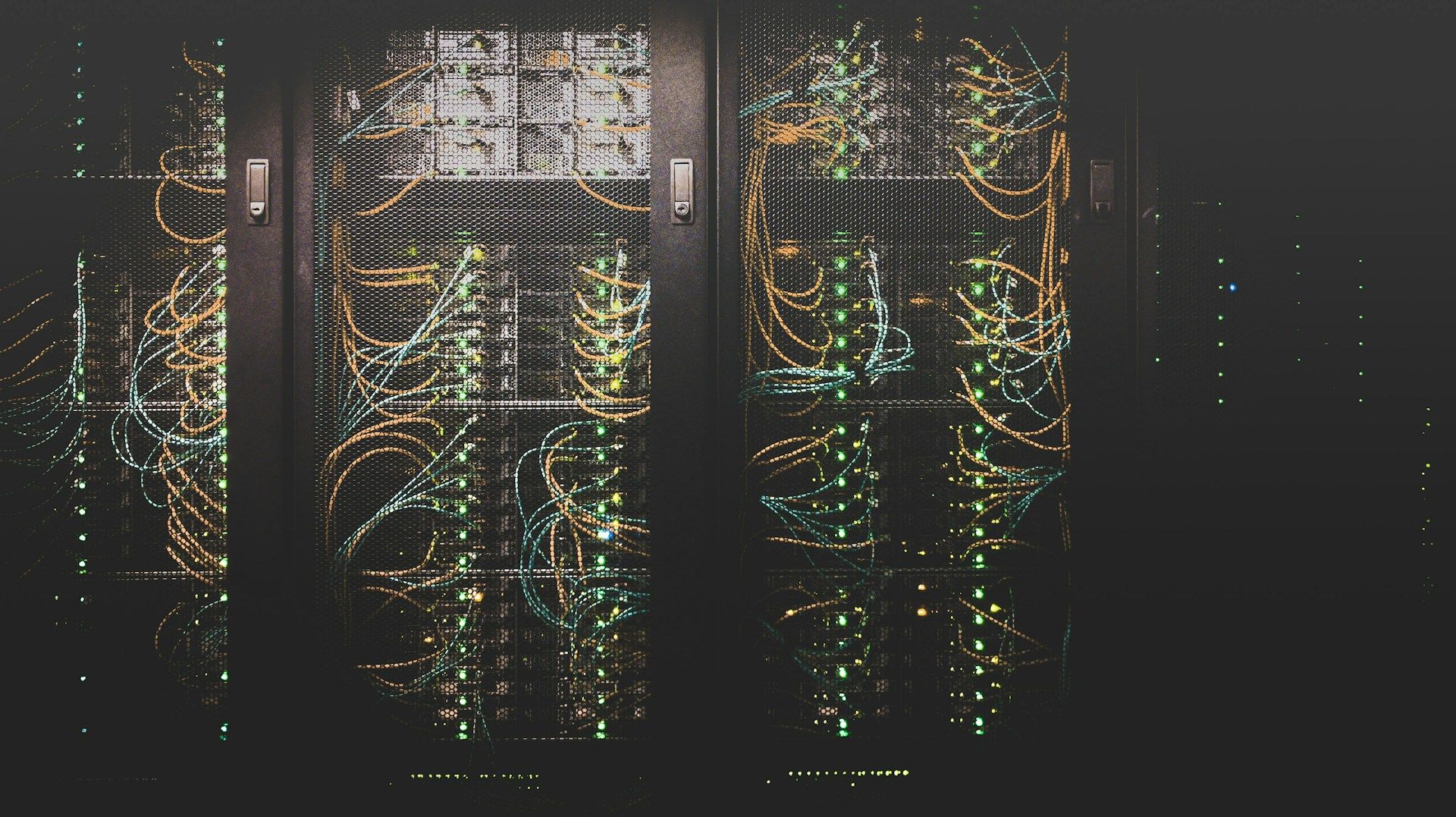

In the meantime, decentralized compute networks are delivering related companies— AI inference, rendering, and compute energy — without having to lift billions in debt or fairness as they act as a dealer connecting present GPUs to customers, saving the capital expenditure of shopping for their very own server farms.

These usually are not theoretical networks. They’re useful methods already processing actual workloads, and the brokerage mannequin works for purchasers.

But their collective market worth stays a fraction of CoreWeave’s. Actually, they do not have the identical stage of workload operating by means of their networks, however the hole is putting. Whereas the market treats GameFi with irrational exuberance, distributed compute tokens could also be affected by the other downside.

Regardless of addressing the identical market want as CoreWeave, and in some methods providing a extra capital-efficient and globally scalable mannequin with out the eye-watering CapEx, they continue to be modestly valued.

Justin Solar-Backed SRM Leisure Broadcasts $100 Million TRX Staking Transfer

SRM Leisure (Nasdaq: SRM), quickly to rebrand as TRON Inc., has staked its total treasury of 365 million TRX tokens by means of JustLend, a transfer that might yield an annual return of as much as 10%, in response to a launch.

The transfer comes on the heels of a $100 million funding spherical closed earlier this month to fund what the corporate calls a “TRON treasury technique,” basically, a public market automobile modeled on bitcoin-holding corporations like MicroStrategy, however for TRX.

That construction offers fairness traders with oblique publicity to a community that performs a dominant position in USDT stablecoin settlement, notably within the International South, the place TRON-based Tether serves as a greenback lifeline – arguably a ‘Visa IPO’ second for the area’s economic system.

Sogni AI Debuts Mainnet, SOGNI Token to Checklist on Kraken, MEXC, Gate.io

Sogni AI, a decentralized platform for generative AI workflows, has launched its mainnet and can record its native token, SOGNI, on Kraken, MEXC, and Gate.io.

SOGNI is the utility token of the Sogni Supernet. It’s used for compute funds, staking, governance, and entry to superior software options.

The mainnet launch contains deployments on Base, an Ethereum Layer-2 developed by Coinbase, and Etherlink, a Tezos-based EVM-compatible Layer-2 utilizing Good Rollups. In a launch, the platform stated this chain-agnostic method is designed to steadiness scalability and accessibility.

The mission’s acknowledged objective is to create an open and economically sustainable setting for inventive AI functions, combining Web3 infrastructure with person instruments that resemble Web2 companies in usability.

The platform additionally makes use of a non-transferable credit score system known as Spark Factors, that are fixed-value rendering credit that may be bought or earned throughout the Sogni ecosystem.

Customers work together with the community by means of three core functions: Sogni Internet, Sogni Pocket, and Sogni Studio. Creators submit generative AI jobs, whereas node operators, or “Staff,” present GPU assets and are compensated in SOGNI tokens.

Market Actions:

- BTC: Bitcoin is buying and selling at $107,200, holding a powerful help zone after a 14,695 BTC quantity spike close to $107K, with merchants eyeing a possible breakout towards $115,000.

- ETH: Ethereum rebounded sharply from a 3.4% intraday drop, at the moment buying and selling at $2,480, forming a V-shaped restoration off $2,438 help, as institutional inflows proceed regardless of broader market uncertainty.

- Gold: Gold is buying and selling at $3,310.95, rebounding from a one-month low as a weaker greenback and Fed strain offset risk-on sentiment.

- Nikkei 225: Asia-Pacific markets traded blended Tuesday as traders weighed Wall Road’s report highs in opposition to looming uncertainty from Trump’s expiring 90-day tariff reprieve, with Japan’s Nikkei 225 down 0.58%

- S&P 500: Shares climbed Monday because the S&P 500 rose 0.52% to a report shut of 6,204.95, capping a powerful month.

Elsewhere in Crypto:

- Senator Seeks to Waive U.S. Taxes on Small-Scale Crypto Exercise in Massive Finances Invoice (CoinDesk)

- Singapore to ‘Thread the Needle’ as Crypto Licensing Guidelines Take Impact (Decrypt)

- Fashionable Monetary Advisor Ric Edelman Says Buyers Ought to Allocate As much as 40% of Wealth to Crypto (CoinDesk)