Hong Kong launched a second coverage assertion to speed up its digital asset (DA) growth and reinforce its ambition to develop into a world chief in monetary innovation.

The most recent assertion, dated June 26 and dubbed “Coverage Assertion 2.0,” expands on the framework specified by its preliminary launch from October 2022.

In response to the Hong Kong authorities, the up to date technique creates a imaginative and prescient for a “trusted and revolutionary digital asset ecosystem” that balances progress with threat administration and investor safety.

The main focus stays on driving real-world monetary advantages whereas nurturing a dynamic, regulatory, and innovation-friendly atmosphere.

Paul Chan, the Monetary Secretary, stated:

“We try to construct a extra flourishing DA ecosystem which can combine the actual economic system with social life by a prudent regulatory regime and encouragement to market innovation, such that it’s going to carry advantages to each the economic system and society whereas consolidating Hong Kong’s main place as a world monetary centre.”

Hong Kong’s LEAP framework

On the core of the coverage is a brand new LEAP framework. This acronym stands for Authorized and regulatory streamlining, Increasing tokenized merchandise, Advancing use instances and cross-sectoral collaboration, and selling individuals and partnership growth.

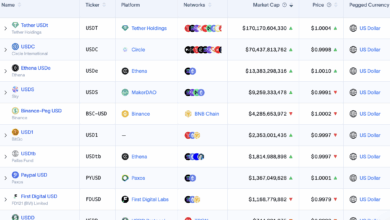

One key growth is the continuing creation of a unified regulatory regime for digital asset service suppliers. The framework will cowl crypto exchanges, stablecoin issuers, digital asset sellers, and custodians.

The Securities and Futures Fee (SFC) will lead the licensing efforts, guaranteeing market contributors meet strict requirements.

In parallel, the Monetary Providers and Treasury Bureau (FSTB) and the Hong Kong Financial Authority (HKMA) will oversee a authorized overview to help the tokenization of real-world belongings. This contains efforts to ease regulatory hurdles in settlement, record-keeping, and registration for tokenized bonds and different devices.

The coverage additionally outlines incentives for tokenizing belongings reminiscent of authorities bonds, treasured metals, and renewable power devices. These efforts goal to spice up liquidity and investor entry. Measures into account embrace favorable tax remedy for tokenized exchange-traded funds (ETFs).

The federal government will push for extra real-world use instances, particularly for stablecoins, to encourage broader adoption throughout the upcoming licensing construction. The authorities additionally plan to enhance collaboration throughout sectors by partaking regulators, regulation enforcement, and tech companies.

Lastly, the assertion emphasizes the significance of expertise growth. New partnerships between the digital asset trade and educational establishments will assist construct the abilities to help long-term innovation and market maturity.