Replace (June 26, 1:26 am UTC): This text has been up to date so as to add info from Invesco’s submitting and analyst commentary.

The US might get 9 Solana exchange-traded funds if regulators approve, as asset supervisor Invesco joined the group of companies trying to push exchange-traded merchandise past Bitcoin and Ethereum.

In a regulatory submitting on Wednesday, Invesco and Galaxy Digital put ahead the Invesco Galaxy Solana ETF, which goals to trace the spot worth of Solana (SOL), at the moment the sixth-largest cryptocurrency by market cap.

It’s the ninth submitting for a Solana-tracking ETF, becoming a member of bids from the likes of VanEck, Bitwise and crypto ETF large Grayscale.

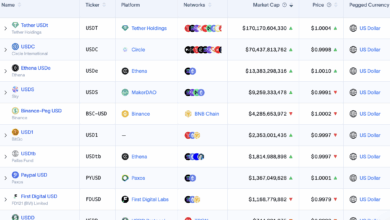

The companies want to take a look at the market’s urge for food for so-called altcoins after the massive success of Bitcoin ETFs launched in early 2024 and milder wins for funds tied to Ether (ETH) that launched later that 12 months.

The Trump administration has promised to ease rules on crypto, setting off a wave of optimism by means of the sector that has seen Bitcoin (BTC) hit new highs and triggered a slate of public firms to collectively increase billions to put money into Bitcoin long-term.

Invesco Galaxy fund to immediately maintain Solana

Invesco and Galaxy’s submitting is a Type S-1 registration assertion that tells the Securities and Change Fee it plans to launch a safety, and it lays out that the deliberate ETF plans to immediately maintain Solana — the identical as different competing ETFs.

Coinbase Custody, the crypto custody arm of crypto trade Coinbase, would maintain the underlying Solana, and the fund would purpose to “replicate the efficiency of the spot worth of Solana.”

The ETF plans to commerce on the Cboe BZX trade underneath the ticker “QSOL.”

The companies might want to submit Type 19b-4, which proposes a rule change to the SEC, for the company to start the method of contemplating approving the ETF.

ETF might stake SOL

The submitting mentioned that Invesco and Galaxy might “once in a while, stake a portion of the Belief’s property by means of a number of trusted staking suppliers.”

It added that the ETF would obtain a reward of extra Solana tokens for locking up a number of the fund’s SOL, which “could also be handled as revenue to the Belief.”

Different asset managers bidding for a Solana ETF up to date their registration statements earlier this month to incorporate language and provisions for staking.

Solana ETFs could possibly be permitted as quickly as July

Bloomberg ETF analyst James Seyffart mentioned in a be aware on June 10 that the SEC “might act early on spot Solana and staking ETF filings” and will approve them in July alongside ETFs monitoring a basket of cryptocurrencies.

Associated: ETH ETF flows impress, however Ether futures knowledge recommend merchants train warning

Bloomberg senior ETF analyst Eric Balchunas commented on the time to “prepare for a possible altcoin ETF summer time with Solana doubtless main the way in which.”

The analysts have given a 90% probability that the SEC will approve the Solana ETF filings. The regulator’s closing deadline to approve the merchandise is Oct. 10, and it’s doubtless all Solana ETFs will launch concurrently to keep away from giving one a bonus.

Together with VanEck, Bitwise, Grayscale, and now Invesco, the opposite Solana ETF bidders are 21Shares, Canary Capital, Bitwise, Franklin Templeton and Constancy Investments.

All 9 issuers in addition to Canary Capital have launched spot Bitcoin and Ether ETFs, whereas Canary has submitted a flurry of ETF filings trying to observe altcoins.

Journal: Child boomers price $79T are lastly getting on board with Bitcoin