Norwegian deep-sea mining agency Inexperienced Minerals AS says it plans to create a Bitcoin treasury and is aiming to lift $1.2 billion to purchase and maintain Bitcoin long-term.

Inexperienced Minerals mentioned on Monday that the plan is a part of a wider blockchain technique that goals to diversify the corporate’s investments from fiat currencies and help its future venture plans.

Inexperienced Minerals government chair Ståle Rodahl mentioned in a press release that Bitcoin (BTC) is an “engaging various to conventional fiat,” and the hope is that including it to the agency’s steadiness sheets will assist by “mitigating fiat dangers.”

“With vital future capital expenditures deliberate for the manufacturing tools, this system provides a strong hedge towards forex debasement.”

First Bitcoin purchase coming in subsequent few days

Inexperienced Minerals mentioned that with its companions, it plans to finance as much as $1.2 billion with applications designed to extend its Bitcoin treasury, and it goals to purchase its first Bitcoin throughout the subsequent few days.

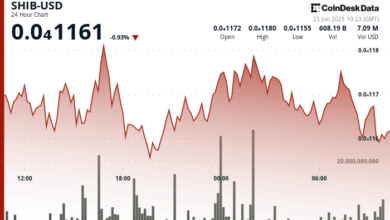

Inexperienced Minerals may purchase roughly 11,255 Bitcoin for $1.2 billion, with it at present buying and selling round $106,500.

The corporate additionally mentioned it would launch a key efficiency indicator, with the brand new metric monitoring the Bitcoin worth attributable to every share.

Blockchain adoption on the playing cards

The mining agency has additionally flagged plans to undertake blockchain know-how “to remain within the forefront of competitors and any future regulatory necessities.”

“Inexperienced Minerals additionally sees that blockchain know-how has an necessary function to play in mining to make sure provide chain transparency, mineral origin certification and operational effectivity,” the corporate added.

Associated: Metaplanet shares soar after $5.4B plan to purchase Bitcoin

Inventory down following crypto announcement

Shares in Inexperienced Minerals closed at a 300% acquire on Monday with its announcement, rising to 68 euro cents (79 cents); nonetheless, its share worth dropped on Tuesday to shut down over 34% to 44 euro cents (51 cents), Google Finance knowledge exhibits.

Some firms have seen their inventory costs surge after saying a Bitcoin shopping for plan.

In Could, shares within the Indonesian fintech agency DigiAsia Corp almost doubled, rising 91%, after the corporate mentioned it was elevating $100 million to seed its first of many buys.

Not all have skilled the spike, although. Norwegian crypto brokerage agency K33 additionally introduced in Could its intent to purchase and maintain the cryptocurrency, however its share worth traded flat, down 1.96%.

Journal: Rise of MicroStrategy clones, Asia dominates crypto adoption: Asia Specific 2024 overview