Mining problem on the Bitcoin

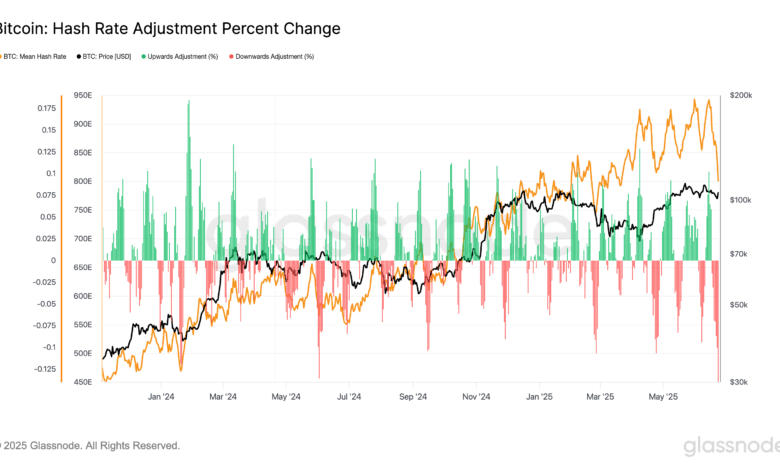

blockchain is on target to drop by probably the most since July 2021 after the quantity of mining energy securing the community slid about 30% in two weeks.

In keeping with information from Mempool.house, a downward problem adjustment of round 9% is projected inside the subsequent 5 days. That might be probably the most because the China mining ban 4 years in the past, when the hashrate, the overall computational energy used to mine blocks, plummeted 50% to 58 exahashes per second (EH/s) and bitcoin was buying and selling close to $30,000.

The issue adjusts each 2,016 blocks to make sure that blocks proceed to be mined at roughly 10-minute intervals. After the current decline, the hashrate is now slightly below 700 EH/s, in response to Glassnode information. The biggest cryptocurrency by market cap was buying and selling just lately round $105,300.

Important hashrate and problem corrections usually are not uncommon in the course of the northern hemisphere’s summer season. Elevated electrical energy costs, pushed by greater air con demand and strained energy grids, typically lead miners to quickly shut off machines, particularly older or much less environment friendly ones. This seasonal sample has been noticed in a number of earlier years.

The anticipated drop in mining problem will present significant reduction for miners. The hashprice, or miner income per exahash, at the moment sits at $51.9. This metric displays the estimated every day revenue in {dollars} a miner earns per EH/s contributed to the community, based mostly on block rewards and transaction charges.

As problem decreases, mining turns into simpler, which means miners can earn extra income for a similar quantity of computational effort. Assuming bitcoin’s value and transaction charges stay steady or improve, the hashprice ought to rise considerably within the coming days, serving to to offset current profitability stress.