Ether whales are betting a whole bunch of tens of millions of {dollars} on the value restoration of the world’s second-largest cryptocurrency regardless of geopolitical tensions which might be sidelining traders and dampening threat urge for food.

One whale (a big cryptocurrency investor) has opened an Ether (ETH) lengthy place of over $101 million with 25x leverage on the entry worth of $2,247, in line with blockchain knowledge from Hypurrscan.

The investor generated over $900,000 in unrealized revenue, however paid over $2.5 million in funding charges. His place stands to be liquidated if Ether’s worth falls under $2,196.

The leveraged guess was opened hours earlier than a second whale withdrew over $40 million value of ETH from Binance, reaching a complete of $112 million value of ETH holdings, in line with blockchain knowledge supplier Onchain Lens.

The exercise comes as Ether slumped to a one-month low of $2,113 on June 22, following US airstrikes on Iran’s nuclear websites. President Donald Trump known as the assaults a “spectacular army success” and warned of additional strikes until Iran agreed to peace, Reuters reported.

The 2 nations have been partaking in strategic missile warfare since June 13, when Israel launched a number of strikes on Iran, marking its largest assault on the nation because the Iran-Iraq Warfare within the Eighties.

Associated: Ether crypto funds see $296M inflows in greatest week since Trump election

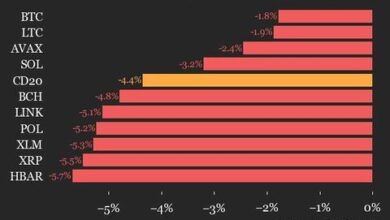

Most Bitcoin (BTC) and Ether merchants anticipate an additional correction after the newest escalation within the ongoing battle.

Round 64% of the trade’s most profitable cryptocurrency merchants are at the moment shorting the world’s two largest cryptocurrencies, whereas solely 36% stay lengthy, in line with the highest Hyperliquid merchants tracked by HyperDash.

Associated: Stablecoin laws to drive Bitcoin market cycle in 2025: Finance Redefined

Ether traders in “wait-and-see” mode

Most Ether traders are at the moment sidelined because of the ongoing geopolitical tensions and financial uncertainty, in line with Nicolai Sondergaard, analysis analyst at crypto intelligence platform Nansen.

“We additionally nonetheless have numerous market uncertainty, whether or not it’s macro or conflict,” the analyst informed Cointelegraph, including:

“These elements, mixed with the truth that if we take a look at choices knowledge, the view remains to be considerably impartial, we’re nonetheless in a form of wait-and-see stage.”

Binance researchers additionally attributed the value drop to geopolitical escalations, including {that a} wider correction should happen.

“Whether or not the acquainted ‘panic-then-recover’ sample re-emerges will hinge on how shortly the geopolitical narrative cools,” in line with a June 20 report from Binance Analysis. “Macro-driven pullbacks are nonetheless being handled as alternatives – not indicators of a broader directional reversal,” the report mentioned.

On June 17, the staked Ether provide reached a brand new all-time excessive of over 35 million, signaling that Ether’s sellable provide is lowering as traders put together to carry their ETH to generate passive yield slightly than promote at present costs.

Journal: 3 causes Ethereum might flip a nook: Kain Warwick, X Corridor of Flame