Ether (ETH)

posted a modest restoration on Saturday after a unstable week marked by outsized institutional outflows. On Friday, June 20, spot ETH ETFs listed within the U.S. recorded $11.3 million in internet outflows — the biggest single-day decline in June, based on knowledge from Farside Buyers.

The pullback was led by BlackRock’s ETHA ETF, which noticed a $19.7 million outflow — its first and solely damaging circulate this month. In distinction, Grayscale’s ETHE product attracted $6.6 million, and VanEck’s ETHV ETF added $1.8 million, partially offsetting losses. No different issuers recorded inflows or outflows.

The information suggests giant establishments could also be lowering their ETH publicity, at the same time as choose funds like Grayscale proceed to draw capital.

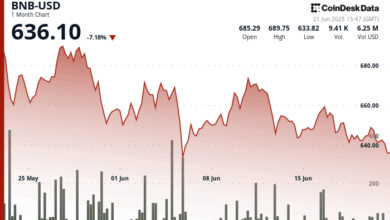

The ETF circulate figures emerged alongside a technical rebound in worth. Ether briefly dipped to $2,372.85 on Friday in a heavy sell-off marked by a quantity spike practically 5 instances the each day common, however swiftly recovered as consumers stepped in across the $2,420–$2,430 vary, based on CoinDesk Analysis’s technical evaluation mannequin. This space has since fashioned a stable help zone, validated by a number of low-volume checks suggesting accumulation.

The 24-hour buying and selling quantity surged 18.97% above the 7-day transferring common, reflecting elevated buying and selling curiosity throughout the worth restoration. ETH closed close to $2,445 and fashioned an ascending trendline of upper lows, although key resistance stays on the $2,480–$2,500 stage.

Technical Evaluation Highlights

- ETH-USD posted a 24-hour buying and selling vary of $186.44 (7.25%), with a steep sell-off to $2,372.85 marking the session low.

- The drop occurred throughout the 17:00 hour and was accompanied by a pointy spike in buying and selling quantity, reaching 993,622 models—practically 5x the each day common.

- A key help zone fashioned between $2,420 and $2,430, strengthened by a number of profitable retests with progressively decrease sell-side quantity.

- ETH reclaimed 38.2% of the Fibonacci retracement from the sell-off and constructed an ascending trendline supported by increased lows.

- Throughout the 08:00–09:00 hour, quantity accelerated once more, signaling bullish momentum and lifting worth towards the $2,445 stage.

- Within the ultimate hour, ETH traded inside a slender $5.83 band, starting from $2,440.14 to a detailed of $2,443.45.

- A late-session rally peaked at $2,447.02 (11:38), with an intra-candle quantity burst of 4,532 models.

- The value then dipped barely however discovered quick help at $2,439.38, persevering with to respect the ascending short-term trendline.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.