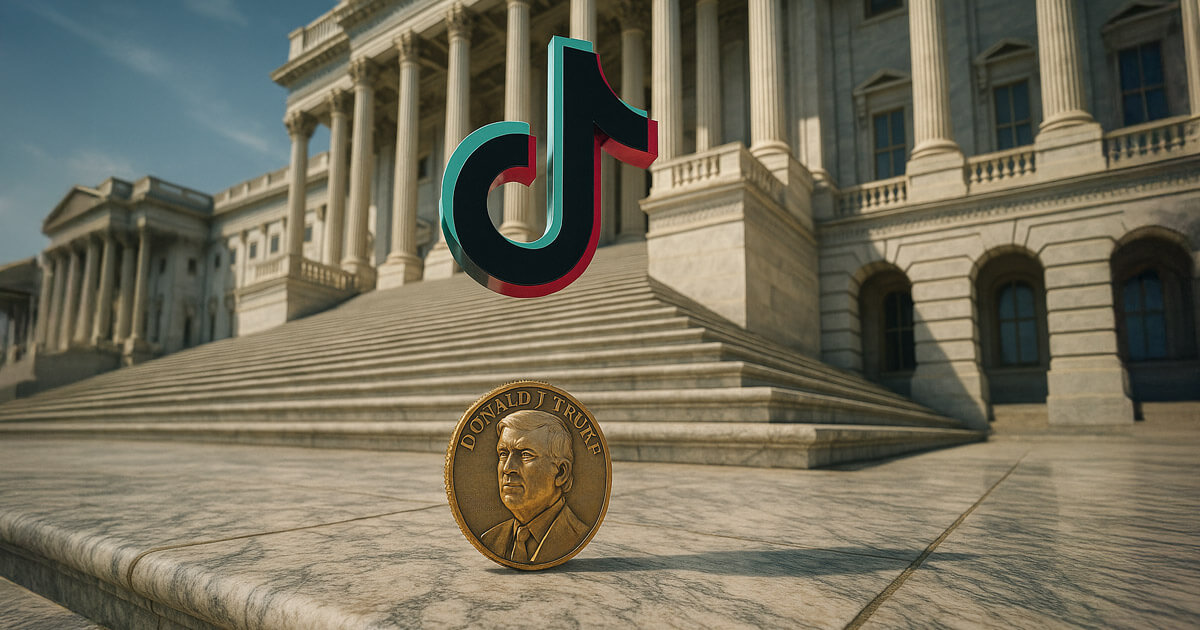

TikTok has publicly denied allegations that it purchased $300 million value of TRUMP memecoins to sway US President Donald Trump.

The corporate addressed the claims on June 19 in a put up on X, labeling the accusation “false and irresponsible” and geared toward misrepresenting its actions.

The assertion adopted feedback by US Congressman Brad Sherman, who prompt that TikTok’s mum or dad firm, ByteDance, bought a big quantity of TRUMP tokens. He claimed the alleged transaction amounted to a direct bribe to President Trump.

Sherman argued that since Trump created the token for free of charge, any purchases funneled monetary advantages straight to him.

TikTok dismissed Sherman’s narrative and highlighted that his interpretation of a current letter was deceptive. The corporate burdened that no such transaction had occurred and described the allegations as baseless.

The timing of the accusation coincides with a brand new Government Order from President Trump, granting TikTok a further 90 days to finalize the sale of its US operations or danger a nationwide ban.

Critics argue that the President lacked authorized grounds to increase the deadline, citing the preliminary regulation handed by Congress that allowed for just one extension.

Trump’s crypto ties set off ethics concern

Past TikTok, the TRUMP memecoin itself is drawing scrutiny from the business.

The token, promoted by the Trump household, has sparked rising issues over conflicts of curiosity. Critics warn {that a} president with direct or oblique ties to digital belongings might face severe questions on ethics, transparency, and international affect.

A number of US lawmakers and nonprofit watchdogs have expressed concern over the potential misuse of political workplace for private monetary achieve, particularly by tokens with no clear use case or underlying worth.

In the meantime, the TRUMP memecoin continues to commerce removed from its all-time excessive and faces constant promote stress. In response to information from CryptoSlate, the token has fallen over 34% previously month.

As of press time, it was buying and selling round $9.43, down considerably from its January all-time excessive of $44.28.