A Kansas banker who looted tens of millions from his small-town financial institution in 2023, which triggered its collapse, misplaced a lot of the cash to abroad crypto scammers focused in a record-breaking DOJ bust, in accordance with a criticism filed Wednesday.

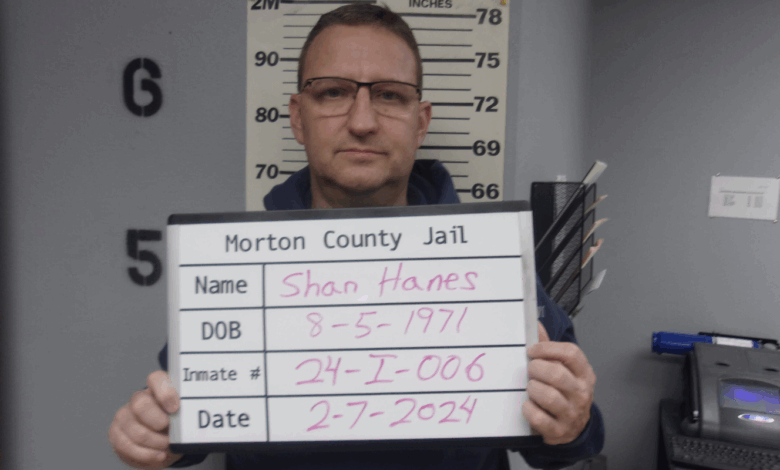

Prosecutors have filed a civil forfeiture motion focusing on over $225 million in laundered USDT, a part of a butchering rip-off with ties to a Philippines name heart that ensnared Shan Hanes, the disgraced former CEO who embezzled $47 million from Heartland Tri-State Financial institution, a theft which was immediately attributed to the agricultural lender’s demise in 2023.

Based on the Division of Justice criticism, OKX, a crypto alternate, offered key data that helped determine an intricate community of accounts on the alternate used to launder the crypto proceeds.

Scammers laundered funds by first directing victims to ship USDT to 93 scam-controlled deposit addresses. From there, the funds had been routed by way of as many as 100 middleman wallets in a course of designed to obscure the supply of funds and blend deposits from a number of victims, in accordance with the criticism.

These laundered funds had been then funneled into 22 major OKX accounts and additional shuffled throughout 122 extra OKX accounts, all linked by shared IP addresses, reused KYC paperwork, and coordinated conduct allegedly traced to a Manila-based rip-off compound, which the criticism names as ITECHNO Specialist Inc.

In complete, the DOJ says that roughly $3 billion in transaction quantity was generated by this laundering community.

Largest victims

In complete, the DOJ says there have been 434 victims and has recognized 60 of them who misplaced a mixed $19.4 million.

The most important of those victims was Hanes, with the DOJ figuring out $3.3 million of the $47 million he embezzled on this seizure.

Hanes embezzled the cash between Might 30, 2023, and July 7, 2023, in accordance with each the DOJ criticism and the Federal Reserve’s report into the collapse of Heartland Tri-State Financial institution, one of many banks to break down within the aftermath of the 2023 U.S. banking disaster.

Throughout this six-week interval, Hanes initiated 10 wire transfers totaling roughly $47.1 million from Heartland Tri-State Financial institution, a small neighborhood lender centered on agricultural loans, to a crypto pockets he managed.

These wire transfers occurred between the financial institution’s quarterly regulatory reporting intervals, permitting the exercise to go initially undetected.

On the time, Heartland was well-capitalized with $13.7 million in capital and $139 million in belongings, however Hanes’ actions depleted its liquidity, triggered $21 million in emergency borrowing, and left the financial institution with a $35 million capital gap, forcing regulators to close it down in July 2023.

Based on prior reporting from CNBC, Hanes additionally stole $40,000 from the Elkhart Church of Christ, $10,000 from the Santa Fe Funding Membership, $60,000 from his daughter’s school fund, and liquidated almost $1 million in inventory from a agency known as Elkhart Monetary to ship to pig butchering scammers.

He was sentenced to 24 years in jail in August 2024.

The DOJ criticism referred to him as each a perpetrator and a sufferer.

Seized crypto doubtless going to Fed stockpile

Crypto seized by the U.S. authorities, resembling on this case, is prone to be earmarked for a not-yet-established stockpile ordered by President Donald Trump.

The bitcoin

reserve and the stockpile of different cryptocurrencies have not but been formally established, however the Treasury Division has been main an audit of governmental digital asset holdings to find out what must be gathered.

As soon as established, the long-term crypto holdings will doubtless put seized bitcoin in a single fund and different sorts of tokens in one other.

The holdings on this case seem like in vital quantities of USDT, in accordance with the submitting. It is unclear what funds might ultimately be returned to victims, as solely a comparatively small proportion of these immediately harmed have been recognized.