- Financial institution of Canada’s Macklem might shift CAD outlook with feedback on tariffs, inflation dangers, and financial momentum.

- The Loonie stays weak with financial coverage divergence in focus.

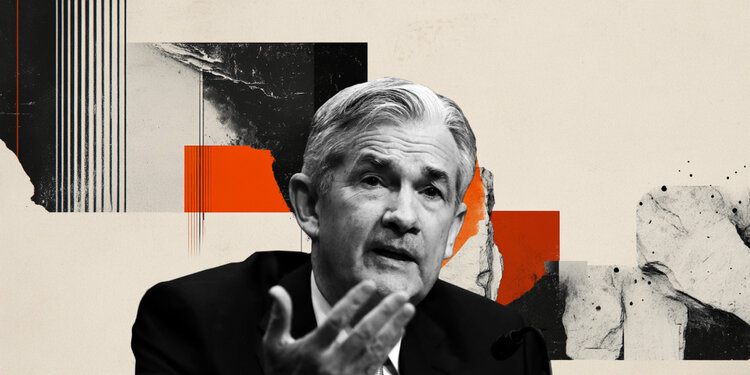

- Fed projections and Powell’s tone might affect the route of the Dollar and bets on a September charge reduce.

The Canadian Greenback (CAD) is buying and selling flat in opposition to the US Greenback (USD) on Wednesday as markets undertake a cautious tone forward of the Federal Reserve’s (Fed) Federal Open Market Committee (FOMC) Assembly.

On the time of writing, USD/CAD is holding regular on the 10-day Easy Transferring Common (SMA) of 1.3651, with volatility anticipated to rise as merchants digest the most recent US financial knowledge and await commentary from the Fed and the Financial institution of Canada (BoC).

Financial figures launched earlier within the session level to a moderation in US development momentum. Might housing begins declined by 9.8% to 1.256 million, falling wanting expectations. Preliminary Jobless Claims registered at 245,000 whereas persevering with claims stood at 1.945 million, indicating a gradual softening in labor market circumstances. These knowledge factors collectively reinforce the argument for a cautious coverage method from the Fed.

Fed to launch up to date projections, Powell’s tone key

The FOMC is predicted to go away rates of interest unchanged at 4.25%–4.50% when it pronounces its determination at 18:00 GMT.

Nonetheless, investor consideration shall be on the up to date Abstract of Financial Projections (SEP) and revised dot plot, which is able to define how Fed officers view the trail for inflation, development, and charges over the approaching months.

In keeping with the CME FedWatch Software, markets at present assign a 58% chance to a charge reduce in September, reflecting softer inflation and slowing demand.

Fed Chair Jerome Powell’s tone on the post-decision press convention shall be crucial. If Chair Powell expresses confidence that inflation is easing and downplays exterior dangers, it may strengthen expectations for charge cuts, providing modest assist to the Canadian Greenback.

Nonetheless, if he highlights lingering tariff uncertainty and the potential inflationary influence of the Israel–Iran battle, it could justify protecting charges larger for longer, supporting the US Greenback and driving USD/CAD larger.

BoC Governor Macklem’s speech might information Canadian charge outlook

Consideration may also flip to Financial institution of Canada Governor Tiff Macklem, who’s scheduled to talk on the St. John’s Board of Commerce at 15:30 GMT.

Governor Tiff Macklem’s speech is anticipated to deal with three core themes related to Canada’s financial outlook.

First, he’s prone to revisit the dangers posed by US-imposed tariffs, notably their influence on Canadian exporters and trade-sensitive industries.

Second, Macklem is predicted to evaluate the labor market and broader financial momentum, particularly amid current indicators of softening development.

Lastly, markets will intently monitor his commentary on inflation dynamics, particularly whether or not the current easing in value strain is sustainable or if further financial coverage changes could also be crucial.

This comes after Macklem delivered his “clear and current hazard” warning in the course of the BoC coverage announcement and press convention on June 4.

Merchants shall be watching each Powell and Macklem for clues on the trajectory of rates of interest. Their feedback may trigger the USD/CAD to shift sharply as coverage divergence and international dangers proceed to be key drivers.

Central banks FAQs

Central Banks have a key mandate which is ensuring that there’s value stability in a rustic or area. Economies are always dealing with inflation or deflation when costs for sure items and providers are fluctuating. Fixed rising costs for a similar items means inflation, fixed lowered costs for a similar items means deflation. It’s the job of the central financial institution to maintain the demand in line by tweaking its coverage charge. For the most important central banks just like the US Federal Reserve (Fed), the European Central Financial institution (ECB) or the Financial institution of England (BoE), the mandate is to maintain inflation near 2%.

A central financial institution has one vital device at its disposal to get inflation larger or decrease, and that’s by tweaking its benchmark coverage charge, generally often known as rate of interest. On pre-communicated moments, the central financial institution will situation a press release with its coverage charge and supply further reasoning on why it’s both remaining or altering (chopping or mountaineering) it. Native banks will regulate their financial savings and lending charges accordingly, which in flip will make it both more durable or simpler for individuals to earn on their financial savings or for firms to take out loans and make investments of their companies. When the central financial institution hikes rates of interest considerably, that is known as financial tightening. When it’s chopping its benchmark charge, it’s known as financial easing.

A central financial institution is commonly politically unbiased. Members of the central financial institution coverage board are passing by means of a sequence of panels and hearings earlier than being appointed to a coverage board seat. Every member in that board usually has a sure conviction on how the central financial institution ought to management inflation and the next financial coverage. Members that need a very unfastened financial coverage, with low charges and low-cost lending, to spice up the economic system considerably whereas being content material to see inflation barely above 2%, are known as ‘doves’. Members that quite wish to see larger charges to reward financial savings and wish to preserve a lit on inflation in any respect time are known as ‘hawks’ and won’t relaxation till inflation is at or simply under 2%.

Usually, there’s a chairman or president who leads every assembly, must create a consensus between the hawks or doves and has his or her ultimate say when it might come right down to a vote break up to keep away from a 50-50 tie on whether or not the present coverage ought to be adjusted. The chairman will ship speeches which regularly might be adopted stay, the place the present financial stance and outlook is being communicated. A central financial institution will attempt to push ahead its financial coverage with out triggering violent swings in charges, equities, or its forex. All members of the central financial institution will channel their stance towards the markets upfront of a coverage assembly occasion. Just a few days earlier than a coverage assembly takes place till the brand new coverage has been communicated, members are forbidden to speak publicly. That is known as the blackout interval.

holding regular on the 10-day Easy Transferring Common of