Paris-listed know-how agency The Blockchain Group expanded its Bitcoin reserves with the acquisition of 182 BTC for about $19.6 million, bringing its whole holdings to 1,653 BTC. At present market costs, the corporate’s stash is valued at over $170 million.

The most recent acquisition by Europe’s first Bitcoin treasury firm, finalized on Tuesday, was funded by means of a sequence of just lately accomplished convertible bond issuances totaling practically 18 million euros ($20.7 million), the agency mentioned in a Wednesday announcement.

Notable traders within the spherical included UTXO Administration, Moonlight Capital, TOBAM and Ludovic Chechin-Laurans. The announcement confirmed that every participant purchased a distinct a part of the corporate’s bond choices.

The purchases had been executed by business banking establishment Banque Delubac & Cie and digital investing financial institution Swissquote Financial institution Europe SA, with custody by Taurus, a Swiss infrastructure supplier for digital property.

Associated: Genius Group Bitcoin treasury grows 52% as 1,000 BTC purpose reaffirmed

Blockchain Group experiences 1,173% BTC yield in 2025

The Blockchain Group claims a year-to-date Bitcoin (BTC) yield of 1,173.2%, reflecting a rise within the ratio of Bitcoin held to its absolutely diluted share rely. For the reason that begin of the 12 months, the corporate has added 469 BTC and reported over $49.4 million in positive aspects in Bitcoin worth.

The agency’s common acquisition price stands at round $103,000 per BTC, decrease than present market costs. With plans underway that might allow the acquisition of a further 70 BTC, whole reserves could quickly method 1,723 BTC.

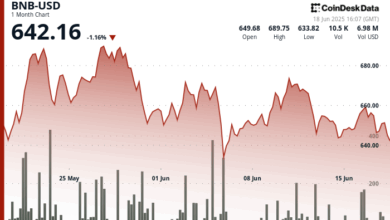

The Blockchain Group is traded below the ticker ALTBG on Euronext Development Paris. The corporate’s shares are down 3.9% at present, in keeping with knowledge from Google Finance.

Earlier this month, The Blockchain Group introduced plans to boost 300 million euros ($342 million) by means of an “On the Market” (ATM)-style providing to spice up its Bitcoin treasury.

The fundraising will happen in tranches, with shares offered at market-driven costs based mostly on the day before today’s shut or the volume-weighted common worth and capped at 21% of every day buying and selling quantity.

Associated: Trump Media’s Bitcoin treasury registration ‘declared efficient’ by SEC

26 entities add Bitcoin to treasury in previous month

A rising variety of public corporations are including Bitcoin to their stability sheets, with at the least 26 entities doing so up to now 30 days, in keeping with BitcoinTreasuries.NET.

Nevertheless, critics warn that some companies could also be turning to Bitcoin as a final resort somewhat than a strategic play. Business voices like Fakhul Miah from GoMining Institutional warning that smaller companies mimicking Technique’s playbook could lack the chance administration required for such strikes.

Commonplace Chartered Financial institution warned that half of those corporations may face severe hassle if Bitcoin fell under $90,000, probably triggering widespread liquidations and harming the asset’s status.

Journal: Older traders are risking every part for a crypto-funded retirement