- The Dow Jones climbed round 350 factors on Monday, reclaiming 42,500.

- Buyers are betting on some form of decision within the Israel-Iran battle that cropped up final week.

- Regardless of a constructive tilt to equities, commerce considerations and Center East conflicts are holding bullish momentum capped.

The Dow Jones Industrial Common (DJIA) discovered firmer footing on Monday, kicking off the brand new buying and selling week on a excessive word and paring away a lot of the late-week losses that pushed indexes into the purple final Friday. Israel launched strikes towards Iranian targets beneath the auspices of denying Iran entry to nuclear weapons. Israel is one in all solely 4 nations to not signal the Nuclear Non-Proliferation Treaty, and can also be not a celebration to the Treaty on the Prohibition of Nuclear Weapons.

Regardless of Israel’s strikes rapidly spiraling out into barrages of missile launches between Iran and Israel that continued via the weekend and into Monday, buyers are nonetheless banking on a possible ceasefire, or at the very least a cooling of regularly rising Center East tensions. Equities rallied on Monday following headlines from the Wall Road Journal that Iran was “open” to the concept of partaking in peace talks with Israel. Nonetheless, the Iranian authorities, via the Qatari state-controlled media outlet Al Jazeera, denied the studies as false. Undeterred, merchants are hedging their bets {that a} decision shall be discovered, somewhat than persevering with to boil over right into a widespread battle.

Aggregated shopper sentiment figures rose for the primary time in virtually seven months final week, including additional stress on the lengthy facet. Rebounding shopper sentiment comes at a time when Federal Reserve (Fed) policymakers are nonetheless locked in “wait and see” mode on attainable financial fallout from the Trump administration’s whiplash commerce “insurance policies”, which primarily encompass threatening after which canceling widespread import taxes.

Consumed deck, one other fee maintain anticipated

The Fed is poised to make one other rate of interest name this week; the central financial institution is broadly anticipated to face pat on rates of interest as soon as once more, a transfer that can possible draw additional ire from President Donald Trump. Trump has expressed frustration at a number of levels on the Fed’s unwillingness to ease rates of interest as he scrambles to discover a technique to make federal debt extra manageable; Trump’s bespoke “Large Stunning Funds Invoice” is anticipated so as to add trillions to the federal deficit over the following decade, regardless of campaigning on a platform of eliminating the federal debt overhang “inside months” of taking workplace.

Based on the CME’s FedWatch Device, rate of interest merchants are at the moment pricing in 70% odds of at the very least a quarter-point fee reduce in September. A follow-up fee trim is anticipated in both October or December, with odds flipping between the 2 on a day-by-day foundation.

Learn extra inventory information: IBM inventory leads Dow Jones increased

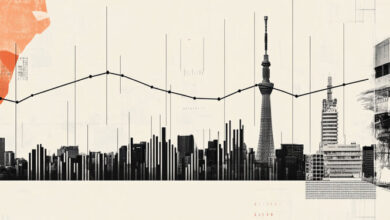

Dow Jones value forecast

Monday’s bullish push has pared again a few of final week’s late losses, pushing the Dow Jones Industrial Common again above 42,500. Nonetheless, the main fairness index stays embroiled in a consolidation zone that has plagued the Dow since mid-Could.

The Dow Jones discovered contemporary highs north of the 43,000 main value deal with final week earlier than Center East headlines knocked investor sentiment decrease, taking DJIA bids with it. The Dow nonetheless has a significant technical ground priced in from the 200-day Exponential Shifting Common (EMA) close to 41,800, and the 50-day EMA is within the means of confirming a bullish cross of the long-run transferring common.

Dow Jones each day chart

Dow Jones FAQs

The Dow Jones Industrial Common, one of many oldest inventory market indices on the planet, is compiled of the 30 most traded shares within the US. The index is price-weighted somewhat than weighted by capitalization. It’s calculated by summing the costs of the constituent shares and dividing them by an element, at the moment 0.152. The index was based by Charles Dow, who additionally based the Wall Road Journal. In later years it has been criticized for not being broadly consultant sufficient as a result of it solely tracks 30 conglomerates, in contrast to broader indices such because the S&P 500.

Many alternative components drive the Dow Jones Industrial Common (DJIA). The mixture efficiency of the part corporations revealed in quarterly firm earnings studies is the primary one. US and world macroeconomic knowledge additionally contributes because it impacts on investor sentiment. The extent of rates of interest, set by the Federal Reserve (Fed), additionally influences the DJIA because it impacts the price of credit score, on which many companies are closely reliant. Due to this fact, inflation is usually a main driver in addition to different metrics which affect the Fed selections.

Dow Concept is a technique for figuring out the first pattern of the inventory market developed by Charles Dow. A key step is to match the path of the Dow Jones Industrial Common (DJIA) and the Dow Jones Transportation Common (DJTA) and solely observe tendencies the place each are transferring in the identical path. Quantity is a confirmatory standards. The idea makes use of parts of peak and trough evaluation. Dow’s idea posits three pattern phases: accumulation, when good cash begins shopping for or promoting; public participation, when the broader public joins in; and distribution, when the good cash exits.

There are a variety of the way to commerce the DJIA. One is to make use of ETFs which permit buyers to commerce the DJIA as a single safety, somewhat than having to purchase shares in all 30 constituent corporations. A number one instance is the SPDR Dow Jones Industrial Common ETF (DIA). DJIA futures contracts allow merchants to take a position on the long run worth of the index and Choices present the best, however not the duty, to purchase or promote the index at a predetermined value sooner or later. Mutual funds allow buyers to purchase a share of a diversified portfolio of DJIA shares thus offering publicity to the general index.