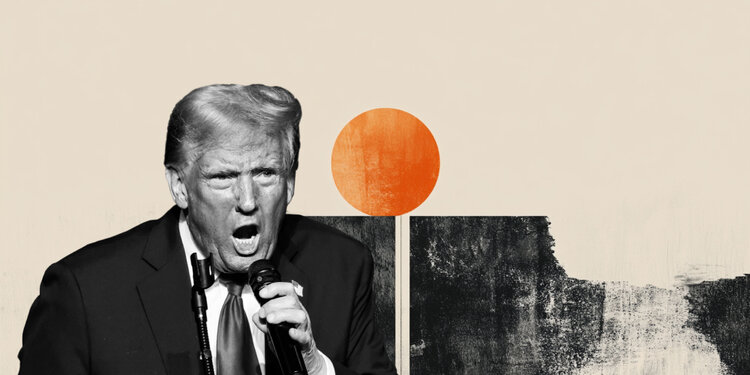

US President Donald Trump stated that “Iran will not be successful this manner,” including that they need to discuss “earlier than it is too late.” He stated that Iranians need to discuss a de-escalation. He additionally delivered some commerce feedback centered on Canada.

Key quotes:

He’s going to debate commerce and plenty of different matters.

Throwing Russia out of G7 was a mistake.

The first focus of talks with Canada is commerce.

A commerce cope with Canada is achievable, however each events should agree.

He would not thoughts China becoming a member of G7

Market’s response

The US Greenback Index (DXY) which tracks the efficiency towards a basket of six friends, is down 0.21% at 97.93. US fairness markets primarily ignored the feedback, because the S&P 500 and the Nasdaq rise to new day by day highs as Gold costs, retreat towards $3,404, shift detrimental on the day, down over 0.84%.

Threat sentiment FAQs

On this planet of monetary jargon the 2 broadly used phrases “risk-on” and “danger off” discuss with the extent of danger that traders are keen to abdomen through the interval referenced. In a “risk-on” market, traders are optimistic in regards to the future and extra keen to purchase dangerous property. In a “risk-off” market traders begin to ‘play it secure’ as a result of they’re frightened in regards to the future, and subsequently purchase much less dangerous property which are extra sure of bringing a return, even whether it is comparatively modest.

Sometimes, in periods of “risk-on”, inventory markets will rise, most commodities – besides Gold – may also acquire in worth, since they profit from a constructive development outlook. The currencies of countries which are heavy commodity exporters strengthen due to elevated demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – particularly main authorities Bonds – Gold shines, and safe-haven currencies such because the Japanese Yen, Swiss Franc and US Greenback all profit.

The Australian Greenback (AUD), the Canadian Greenback (CAD), the New Zealand Greenback (NZD) and minor FX just like the Ruble (RUB) and the South African Rand (ZAR), all are inclined to rise in markets which are “risk-on”. It’s because the economies of those currencies are closely reliant on commodity exports for development, and commodities are inclined to rise in value throughout risk-on intervals. It’s because traders foresee larger demand for uncooked supplies sooner or later as a consequence of heightened financial exercise.

The key currencies that are inclined to rise in periods of “risk-off” are the US Greenback (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Greenback, as a result of it’s the world’s reserve forex, and since in occasions of disaster traders purchase US authorities debt, which is seen as secure as a result of the biggest financial system on the planet is unlikely to default. The Yen, from elevated demand for Japanese authorities bonds, as a result of a excessive proportion are held by home traders who’re unlikely to dump them – even in a disaster. The Swiss Franc, as a result of strict Swiss banking legal guidelines provide traders enhanced capital safety.