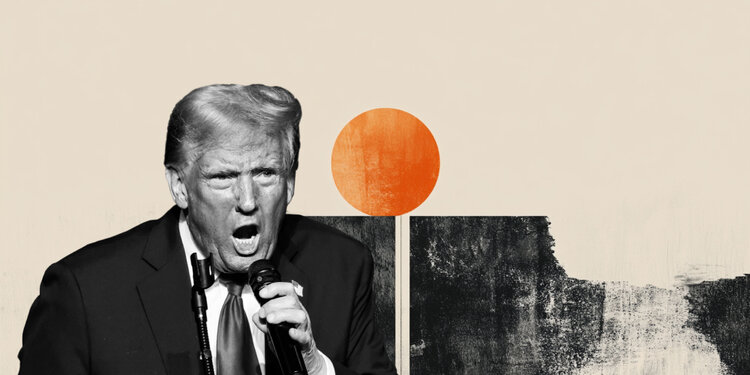

US President Donald Trump stated on Sunday that the USA will proceed to assist Israel, including that he hopes there shall be a deal between Iran and Israel however they need to struggle it out.

Trump opposed an Israeli plan to kill Iran’s Supreme Chief Ayatollah Ali Khamenei because the US President prefers to maintain the US out of the fray for now.

Key quotes

Says he hopes there shall be a deal between Iran and Israel, however typically it’s a must to struggle it out.

Says he doesn’t need to say if he has requested Israel to pause strikes on Iran.

Says US will proceed to assist Israel in its protection.

Market response

On the time of writing, the Gold value (XAU/USD) is buying and selling 0.41% larger on the day to commerce at $3,445.

Threat sentiment FAQs

On this planet of monetary jargon the 2 extensively used phrases “risk-on” and “danger off” discuss with the extent of danger that traders are prepared to abdomen through the interval referenced. In a “risk-on” market, traders are optimistic in regards to the future and extra prepared to purchase dangerous property. In a “risk-off” market traders begin to ‘play it secure’ as a result of they’re apprehensive in regards to the future, and subsequently purchase much less dangerous property which can be extra sure of bringing a return, even whether it is comparatively modest.

Usually, during times of “risk-on”, inventory markets will rise, most commodities – besides Gold – will even acquire in worth, since they profit from a optimistic progress outlook. The currencies of countries which can be heavy commodity exporters strengthen due to elevated demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – particularly main authorities Bonds – Gold shines, and safe-haven currencies such because the Japanese Yen, Swiss Franc and US Greenback all profit.

The Australian Greenback (AUD), the Canadian Greenback (CAD), the New Zealand Greenback (NZD) and minor FX just like the Ruble (RUB) and the South African Rand (ZAR), all are likely to rise in markets which can be “risk-on”. It’s because the economies of those currencies are closely reliant on commodity exports for progress, and commodities are likely to rise in value throughout risk-on intervals. It’s because traders foresee better demand for uncooked supplies sooner or later on account of heightened financial exercise.

The key currencies that are likely to rise during times of “risk-off” are the US Greenback (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Greenback, as a result of it’s the world’s reserve forex, and since in instances of disaster traders purchase US authorities debt, which is seen as secure as a result of the most important economic system on this planet is unlikely to default. The Yen, from elevated demand for Japanese authorities bonds, as a result of a excessive proportion are held by home traders who’re unlikely to dump them – even in a disaster. The Swiss Franc, as a result of strict Swiss banking legal guidelines provide traders enhanced capital safety.