US-based spot Ether exchange-traded funds (ETFs) have posted the primary internet outflow day after a document 19-day streak of consecutive inflows.

On June 13, spot Ether (ETH) ETFs recorded internet outflows of $2.1 million, ending the longest influx streak because the merchandise’ launch in July 2024, in response to Farside information.

Streak beats earlier document by a single day

The streak started on Might 16, excluding the market closure on Might 26 for US Memorial Day.

The ETFs gathered a complete of $1.37 billion in inflows over the 19-day streak, representing roughly 35% of the merchandise’ whole $3.87 billion internet inflows.

Earlier than this, the longest influx streak for spot Ether ETFs was 18 days, which ended on Dec. 19 amid broader crypto market optimism following US President Donald Trump’s election win in November.

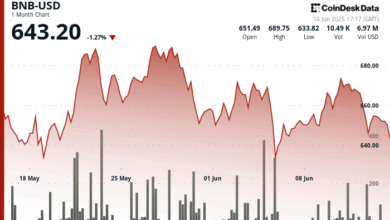

Crypto analyst ZeroHedge mentioned in a June 13 put up on X that regardless of a document streak of consecutive influx days, Ether is buying and selling decrease than it was initially of the stretch on Might 16, when it was buying and selling at $2,620.

On the time of publication, Ether is buying and selling at $2,552, in response to CoinMarketCap information.

On June 11, spot Ether ETFs noticed its greatest influx with $240.3 million in over 4 months, since Feb. 4 when it posted $307.8 million.

Many business individuals consider spot Ether ETFs require a staking characteristic to draw better curiosity. On March 20, BlackRock’s head of digital belongings, Robbie Mitchnick, mentioned that the ETF is “much less excellent” with out staking.

Optimism for Ether is rising

In the meantime, Santiment analyst Brian Quinlivan not too long ago informed Cointelegraph that there’s a “excessive degree of optimism towards Ethereum.”

Associated: SharpLink buys $463M in ETH, turns into largest public ETH holder

“Increasingly more eyes have turned to Ethereum,” he mentioned on June 11, including that the asset has been “taking part in catch-up since markets started their restoration in mid-April.”

Nevertheless, traditionally, Q3 has delivered the bottom common returns for Ether, averaging simply 0.88% since 2013, in response to CoinGlass information.

On June 13, sports activities betting platform SharpLink Gaming acquired 176,271 Ether for $463 million, changing into the world’s largest publicly traded holder of ETH.

Journal: Older traders are risking all the things for a crypto-funded retirement